The insurance industry, with its complex web of policies, claims, and customer interactions, stands to gain significantly from streamlined operations. For many agencies, the dream is to seamlessly connect their Customer Relationship Management (CRM) system with their Enterprise Resource Planning (ERP) system. This integration unlocks powerful automation capabilities, reducing manual data entry, improving data accuracy, and ultimately, freeing up agents to focus on what they do best: building relationships and closing deals.

However, automating ERP functions within a CRM for an insurance agency isn’t a simple plug-and-play affair. It requires careful planning, a deep understanding of your agency’s specific needs, and a strategic approach to implementation. Rushing into the process without proper preparation can lead to frustration, wasted resources, and a system that doesn’t deliver on its promises. This guide provides a comprehensive roadmap for insurance agencies looking to successfully integrate CRM and ERP functionalities through automation.

We’ll break down the essential steps, from initial needs assessment to post-implementation monitoring, highlighting key features and considerations along the way. By following these guidelines, your agency can leverage the power of CRM–ERP automation to achieve greater efficiency, improved customer satisfaction, and a stronger bottom line. Let’s dive in!

Understanding the Synergy: CRM and ERP in Insurance

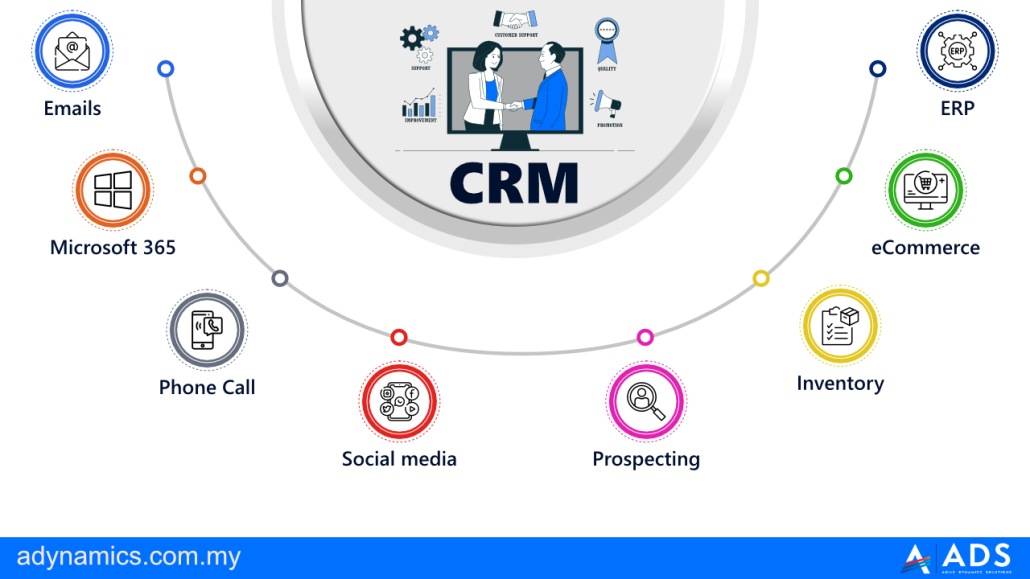

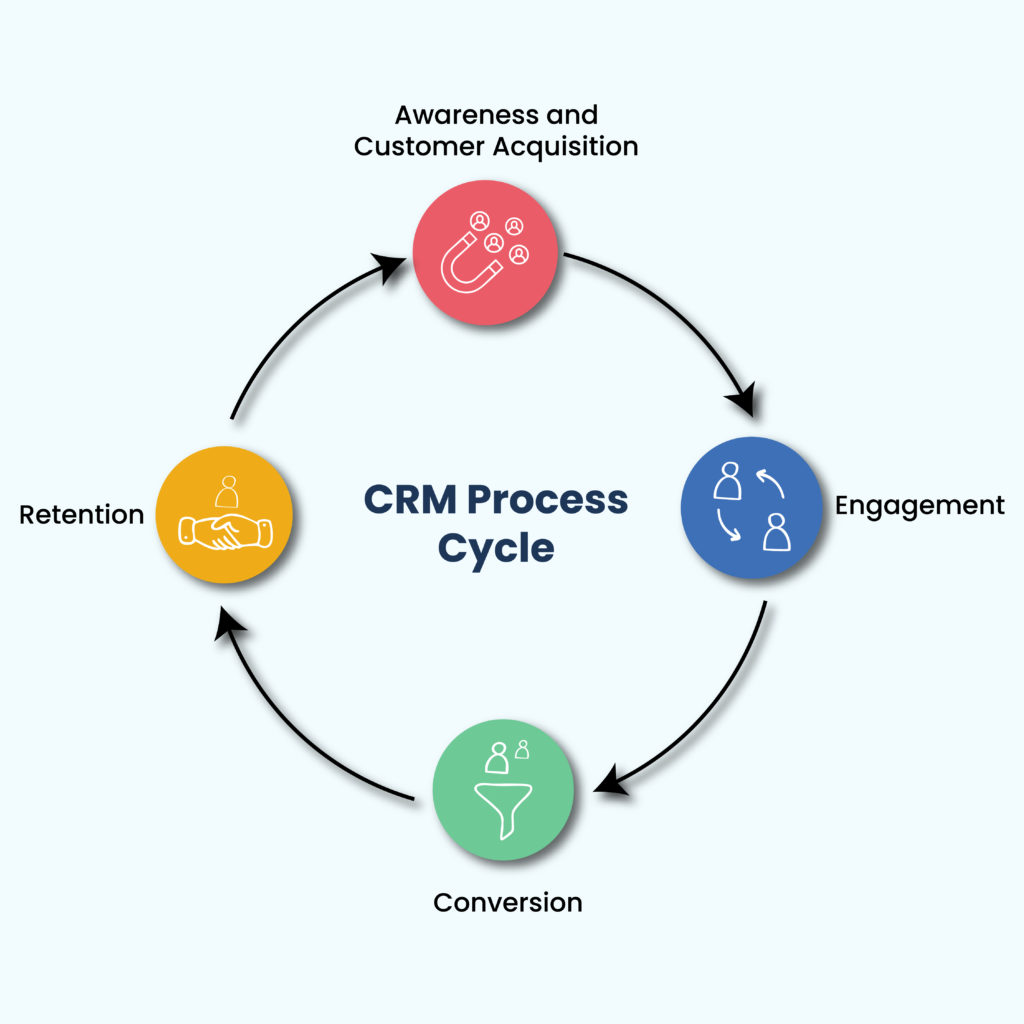

Before embarking on the automation journey, it’s crucial to understand the distinct roles of CRM and ERP systems and how they can work together harmoniously within an insurance agency. Think of CRM as the front office, focused on managing customer interactions, sales processes, and marketing efforts. ERP, on the other hand, is the back office, handling core business functions like finance, accounting, human resources, and policy administration. When these systems are integrated, information flows seamlessly between them, eliminating silos and providing a 360-degree view of the business.

Key Benefits of CRM–ERP Integration for Insurance Agencies

- Improved Data Accuracy: Eliminates manual data entry and reduces the risk of errors.

- Enhanced Efficiency: Automates repetitive tasks, freeing up agents to focus on higher-value activities.

- Better Customer Service: Provides agents with a complete view of customer interactions and policy information.

- Streamlined Policy Administration: Automates policy renewals, endorsements, and cancellations.

- Increased Sales: Identifies cross-selling and upselling opportunities based on customer data.

- Improved Reporting and Analytics: Provides real-time insights into key business metrics.

- Reduced Operational Costs: Optimizes resource allocation and reduces administrative overhead.

Step 1: Conduct a Thorough Needs Assessment

The first and arguably most important step is to conduct a thorough needs assessment. This involves identifying the specific pain points within your agency that CRM–ERP automation can address. Ask yourself: What are the most time-consuming and error-prone processes? Where are the biggest bottlenecks in our workflow? What data is currently siloed, and how is that affecting our decision-making? This process should involve input from all relevant stakeholders, including agents, managers, and IT staff.

Identifying Key Areas for Automation

- Policy Quoting and Application: Automate the process of generating quotes and submitting applications.

- Policy Management: Streamline policy renewals, endorsements, and cancellations.

- Claims Processing: Automate claims intake, assignment, and settlement.

- Billing and Invoicing: Automate premium billing and invoice generation.

- Commission Management: Automate commission calculation and payment.

- Reporting and Analytics: Automate the generation of key performance indicators (KPIs) and reports.

Step 2: Define Clear Objectives and KPIs

Once you’ve identified your agency’s needs, the next step is to define clear, measurable, achievable, relevant, and time-bound (SMART) objectives and Key Performance Indicators (KPIs). What specific outcomes do you hope to achieve through CRM–ERP automation? For example, you might aim to reduce policy processing time by 20% or increase customer retention by 10%. Establishing these objectives upfront will provide a clear roadmap for the implementation process and allow you to track your progress along the way.

Examples of Relevant KPIs for Insurance Agencies

- Policy Processing Time: The average time it takes to process a new policy or renewal.

- Claims Processing Time: The average time it takes to settle a claim.

- Customer Retention Rate: The percentage of customers who renew their policies.

- Customer Satisfaction Score (CSAT): A measure of customer satisfaction with your agency’s services.

- Sales Conversion Rate: The percentage of leads that convert into customers.

- Agent Productivity: The number of policies sold or claims processed per agent.

Step 3: Evaluate and Select the Right CRM and ERP Systems

If you don’t already have both a CRM and ERP system in place, or if your existing systems are outdated or lack the necessary integration capabilities, you’ll need to evaluate and select the right solutions for your agency. This is a critical decision that will have a significant impact on the success of your automation efforts. Look for systems that are specifically designed for the insurance industry and offer robust integration capabilities. Consider factors such as functionality, scalability, ease of use, and vendor support.

Key Features to Look for in a CRM for Insurance Agencies

- Lead Management: Tools for capturing, tracking, and nurturing leads.

- Contact Management: A centralized database for storing and managing customer information.

- Policy Management: The ability to view and manage customer policies.

- Sales Automation: Tools for automating sales tasks, such as quote generation and follow-up.

- Marketing Automation: Tools for automating marketing campaigns, such as email marketing and social media marketing.

- Reporting and Analytics: Dashboards and reports for tracking key performance indicators.

Key Features to Look for in an ERP for Insurance Agencies

- Policy Administration: Tools for managing policy creation, renewals, and cancellations.

- Claims Management: Tools for processing claims, from intake to settlement.

- Billing and Invoicing: Tools for generating invoices and managing payments.

- Commission Management: Tools for calculating and paying commissions.

- Financial Accounting: Tools for managing general ledger, accounts payable, and accounts receivable.

- Human Resources Management: Tools for managing employee information, payroll, and benefits.

Step 4: Plan the Integration Process

Once you’ve selected your CRM and ERP systems, the next step is to plan the integration process. This involves defining the scope of the integration, identifying the data that will be exchanged between the systems, and determining the integration method. You’ll also need to develop a detailed project plan that outlines the tasks, timelines, and resources required for the integration.

Integration Methods: API vs. Custom Development

There are two primary methods for integrating CRM and ERP systems: using Application Programming Interfaces (APIs) or developing custom integrations. APIs are pre-built interfaces that allow different systems to communicate with each other. Custom integrations, on the other hand, involve writing custom code to connect the systems. APIs are generally faster and less expensive to implement, but custom integrations may be necessary if your systems have unique requirements.

Step 5: Implement the Integration and Test Thoroughly

With the planning phase complete, it’s time to implement the integration. This involves configuring the systems, writing any necessary code, and migrating data. Once the integration is complete, it’s crucial to test it thoroughly to ensure that the systems are communicating correctly and that the data is accurate. This testing should involve all relevant stakeholders and should cover all key business processes.

User Acceptance Testing (UAT)

A critical part of the testing phase is User Acceptance Testing (UAT). This involves having end-users (agents, managers, etc.) test the integrated system to ensure that it meets their needs and that it’s easy to use. UAT is an opportunity to identify any remaining bugs or usability issues before the system is rolled out to the entire agency.

Step 6: Train Your Staff

Even the most well-designed CRM–ERP integration will fail if your staff doesn’t know how to use it effectively. Therefore, it’s essential to provide comprehensive training to all users. This training should cover all aspects of the integrated system, including how to access data, perform common tasks, and troubleshoot issues. Consider offering different training formats, such as online tutorials, in-person workshops, and job aids.

Step 7: Go Live and Monitor Performance

Once the integration has been implemented and tested, and your staff has been trained, it’s time to go live. This involves migrating your agency’s data to the new system and switching over to the integrated workflow. After going live, it’s important to monitor the system’s performance closely to identify any issues and ensure that it’s meeting your objectives. Track your KPIs and make adjustments as needed.

Post-Implementation Support and Maintenance

CRM–ERP integration is not a one-time project. It requires ongoing support and maintenance to ensure that the system continues to function properly and meet your agency’s evolving needs. Establish a process for addressing user questions, resolving technical issues, and implementing updates and enhancements.

Step 8: Continuously Optimize and Improve

The final step is to continuously optimize and improve your CRM–ERP integration. As your agency grows and your business needs change, you’ll need to adapt your systems and processes accordingly. Regularly review your KPIs, gather feedback from users, and identify opportunities for further automation and improvement. This iterative approach will help you maximize the value of your CRM–ERP investment and ensure that it continues to support your agency’s success.

Embracing the Future of Insurance Automation

By following these steps, insurance agencies can successfully automate ERP functions within their CRM systems, unlocking a wealth of benefits, including improved efficiency, enhanced customer service, and increased profitability. The key is to approach the process strategically, with a clear understanding of your agency’s needs, objectives, and resources. Embrace the future of insurance automation, and position your agency for long-term success in an increasingly competitive market.

Conclusion

In conclusion, automating ERP functions within your CRM system is no longer a luxury, but a necessity for insurance agencies aiming for sustainable growth and enhanced client satisfaction. By strategically integrating these two powerful systems, agencies can streamline operations, eliminate data silos, and gain a 360-degree view of their customers, ultimately leading to improved efficiency, reduced costs, and better decision-making. The steps outlined in this article – from identifying key processes to selecting the right technology and implementing robust training programs – provide a clear roadmap for achieving successful CRM–ERP integration.

Reflecting on the discussed benefits, it’s evident that the synergy between CRM and ERP empowers insurance agencies to deliver personalized experiences, optimize resource allocation, and adapt quickly to evolving market demands. The future of insurance lies in leveraging technology to create seamless, data-driven workflows. To unlock the full potential of your agency, consider exploring the specific integration options available for your existing CRM and ERP systems. Reflecting on the discussed benefits, it’s evident that the synergy between Customer relationship management and ERP empowers insurance agencies to deliver personalized experiences, optimize resource allocation, and adapt quickly. Don’t hesitate to consult with experienced technology partners who can guide you through the process and help you implement a solution that perfectly fits your unique needs. Visit our contact page to schedule a consultation and discover how CRM–ERP automation can transform your insurance agency.

Frequently Asked Questions (FAQ) about Steps to CRM Automate ERP Functions for Insurance Agencies

How can CRM automate insurance ERP?

CRM systems automate ERP functions by integrating sales, marketing, and service data with accounting and operational processes. This integration streamlines workflows, automates data entry, and improves reporting for insurance agencies.

What are the benefits of CRM/ERP integration?

CRM and ERP integration offers benefits like improved data accuracy, enhanced customer service, and increased operational efficiency for insurance agencies. Automation reduces manual errors and provides a unified view of customer information.

What steps are involved in CRM automation?

CRM automation involves defining business processes, selecting appropriate software, integrating systems, and training staff. Starting with clear goals and phased implementation ensures a successful transition for insurance agencies.