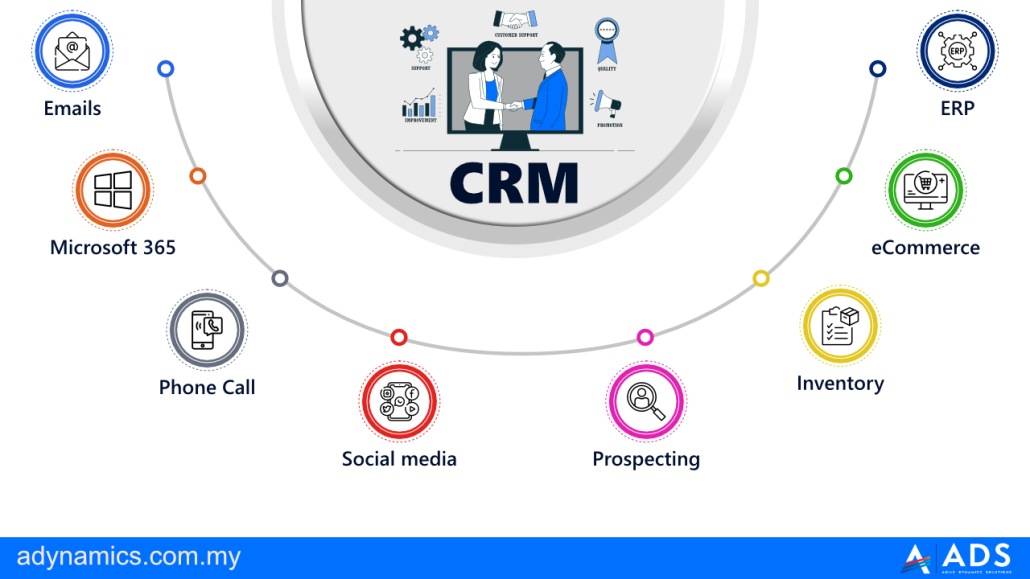

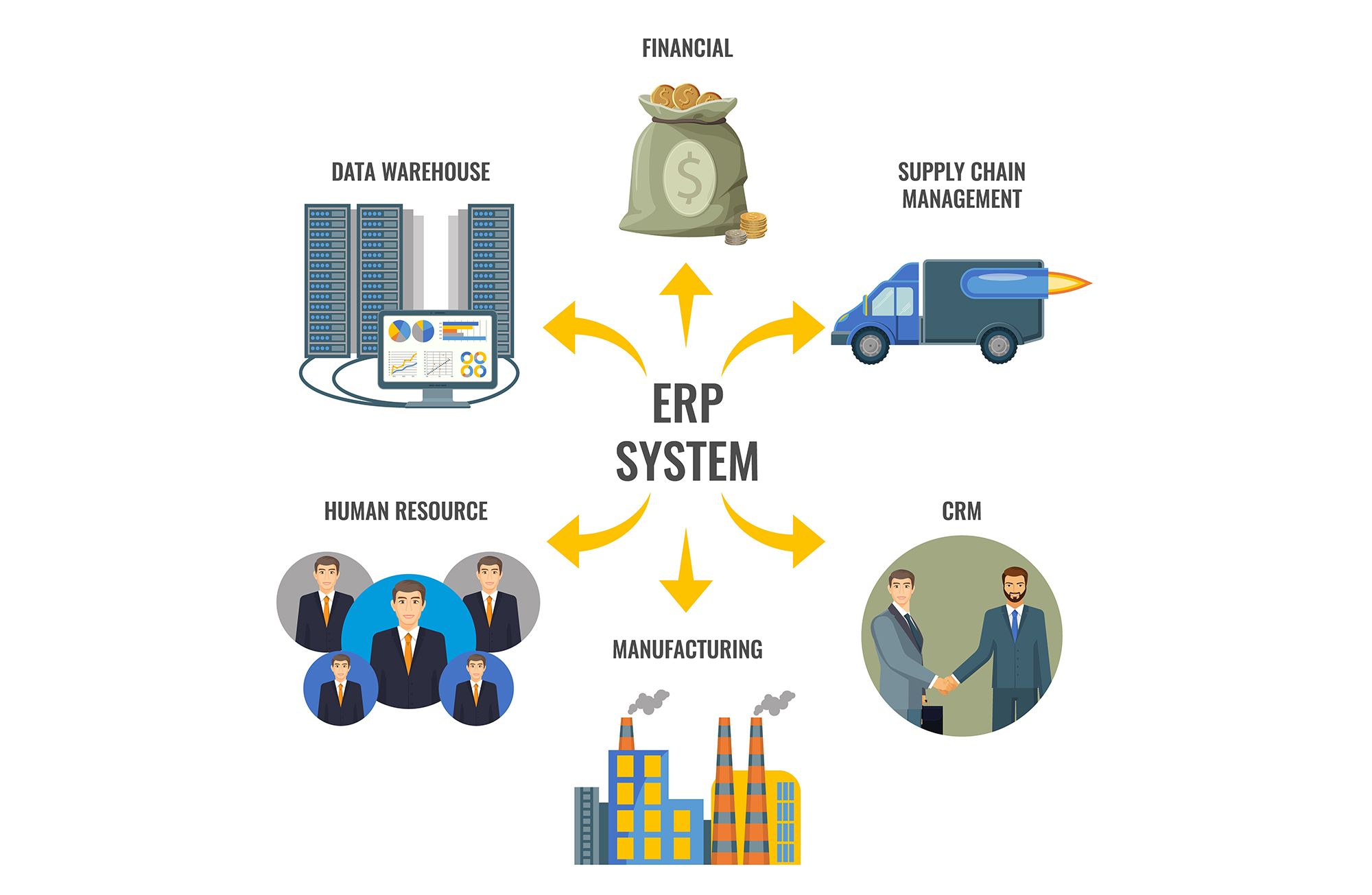

The insurance industry, with its complex regulations, diverse product offerings, and high customer expectations, demands robust and flexible systems. While Enterprise Resource Planning (ERP) systems provide a solid backbone for managing core business processes like finance, human resources, and supply chain, they often lack the agility needed to adapt to rapidly changing market conditions and customer needs. This is where Customer Relationship Management (CRM) systems come into play. Integrating and optimizing CRM with ERP can significantly enhance the flexibility and responsiveness of insurance systems, leading to improved customer satisfaction, increased efficiency, and a stronger competitive advantage.

Think of your ERP as the engine of your insurance company – powerful and reliable, but perhaps a bit rigid in its movements. Your CRM, on the other hand, is the steering wheel, allowing you to navigate the ever-changing landscape of customer demands and market opportunities. When properly integrated, these two systems work in harmony, providing a holistic view of your business and enabling you to make informed decisions quickly. This article will guide you through the steps necessary to strengthen ERP flexibility in insurance systems using CRM, exploring key features and providing practical insights gained from real-world implementations.

We’ll delve into the specific challenges faced by insurance companies when it comes to system flexibility, the benefits of a well-integrated CRM–ERP solution, and a detailed roadmap for achieving this integration. We’ll also look at the crucial features to consider when selecting a CRM system and how to tailor its implementation to the unique needs of the insurance industry. By the end of this guide, you’ll have a clear understanding of how to leverage CRM to unlock the full potential of your ERP system and create a more agile and customer-centric insurance organization. We’ll delve into the specific challenges faced by insurance companies when it comes to system flexibility, and how to address them, as detailed in Steps To CRM Automate ERP Functions For Insurance, the benefits of a well-integrated CRM-ERP solution, and a detailed roadmap for

Understanding the Need for Flexibility in Insurance Systems

Insurance companies operate in a dynamic environment characterized by evolving customer expectations, regulatory changes, and increasing competition. A rigid ERP system can hinder an insurer’s ability to respond effectively to these challenges. Here’s why flexibility is crucial:

Adapting to New Products and Services

Insurance companies are constantly developing new products and services to meet the changing needs of their customers. A flexible system allows for the quick and easy configuration of these new offerings, including pricing, underwriting rules, and policy administration processes. Without this agility, launching new products becomes a slow and cumbersome process, potentially losing market share to more nimble competitors.

Responding to Regulatory Changes

The insurance industry is heavily regulated, and compliance requirements are constantly evolving. A flexible system can be quickly adapted to accommodate these changes, ensuring that the company remains compliant and avoids costly penalties. This includes updates to policy forms, reporting requirements, and claims processing procedures.

Personalizing Customer Interactions

Customers today expect personalized service and tailored solutions. A flexible system allows insurers to capture and analyze customer data, enabling them to provide more relevant and targeted offers. This includes customized pricing, policy recommendations, and communication strategies.

Streamlining Claims Processing

Efficient claims processing is essential for customer satisfaction and profitability. A flexible system can automate many of the steps involved in claims processing, reducing cycle times and improving accuracy. This includes automated document routing, fraud detection, and payment processing.

Benefits of Integrating CRM with ERP in Insurance

Integrating CRM with ERP offers numerous benefits for insurance companies, particularly in enhancing system flexibility. Here’s a breakdown of the key advantages:

Improved Customer Service

By providing a 360-degree view of the customer, CRM enables insurance agents and customer service representatives to provide more informed and personalized service. They can access information on policy details, claims history, and past interactions, allowing them to quickly resolve issues and build stronger relationships.

Enhanced Sales and Marketing Effectiveness

CRM provides valuable insights into customer behavior and preferences, allowing insurers to target their marketing efforts more effectively. By segmenting customers based on demographics, policy types, and risk profiles, they can create more relevant and personalized campaigns. This leads to higher conversion rates and increased sales.

Streamlined Operations

Integrating CRM with ERP streamlines many of the operational processes within an insurance company. For example, when a new policy is sold through CRM, the information can be automatically transferred to the ERP system, eliminating the need for manual data entry and reducing the risk of errors. This improves efficiency and reduces costs.

Better Decision-Making

By providing access to comprehensive data on customers, policies, and claims, the integrated CRM–ERP system enables insurance executives to make more informed decisions. They can identify trends, track performance, and allocate resources more effectively. This leads to improved profitability and a stronger competitive advantage.

Increased Agility

A well-integrated CRM–ERP system provides the agility needed to respond quickly to changing market conditions and customer needs. It allows insurers to launch new products and services more quickly, adapt to regulatory changes more easily, and personalize customer interactions more effectively.

Steps to Strengthen ERP Flexibility with CRM

Here’s a step-by-step guide to strengthening ERP flexibility in insurance systems using CRM:

1. Define Clear Objectives and Goals

Before embarking on a CRM implementation or integration project, it’s crucial to define clear objectives and goals. What specific areas of your business do you want to improve? What are the key metrics you will use to measure success? For example, you might aim to increase customer retention by 10%, reduce claims processing time by 20%, or improve sales conversion rates by 15%. Having clearly defined objectives will help you stay focused and ensure that the project delivers the desired results.

2. Assess Your Current ERP System

Evaluate your existing ERP system to identify its strengths and weaknesses. What are the limitations that are hindering your ability to respond to changing market conditions? What areas of the system are difficult to customize or integrate with other applications? Understanding the limitations of your ERP system will help you determine the specific functionalities that need to be addressed by the CRM system.

3. Select the Right CRM System

Choosing the right CRM system is critical to the success of the project. Consider factors such as the size and complexity of your business, the specific needs of your insurance operations, and your budget. Look for a CRM system that is specifically designed for the insurance industry and offers features such as policy management, claims tracking, and agent management. Also, ensure that the CRM system is compatible with your existing ERP system and offers robust integration capabilities.

4. Plan the Integration

Careful planning is essential for a successful CRM–ERP integration. Develop a detailed integration plan that outlines the scope of the project, the data that will be exchanged between the two systems, and the timelines for implementation. Identify the key stakeholders and assign responsibilities. Consider using a phased approach to integration, starting with the most critical areas and gradually expanding the scope of the project.

5. Implement the CRM System

Implement the CRM system according to the integration plan. This includes installing the software, configuring the system, and migrating data from your existing systems. Provide adequate training to your employees on how to use the new system. Monitor the implementation process closely and address any issues that arise promptly.

6. Integrate CRM and ERP

Integrate the CRM system with your ERP system. This involves establishing a connection between the two systems and configuring the data exchange. Ensure that the data is synchronized accurately and in real-time. Test the integration thoroughly to ensure that it is working as expected.

7. Customize the CRM System

Customize the CRM system to meet the specific needs of your insurance operations. This includes configuring the system to support your unique policy types, underwriting rules, and claims processing procedures. Develop custom reports and dashboards to track key performance indicators.

8. Train Your Employees

Provide comprehensive training to your employees on how to use the integrated CRM–ERP system. This includes training on the CRM system itself, as well as training on the integrated workflows. Ensure that your employees understand how the new system will improve their productivity and efficiency.

9. Monitor and Evaluate

Monitor the performance of the integrated CRM–ERP system and evaluate its effectiveness in achieving the defined objectives. Track key metrics such as customer retention, claims processing time, and sales conversion rates. Identify areas for improvement and make adjustments to the system as needed.

10. Continuously Improve

CRM and ERP systems are not static. Continuously monitor the system, gather feedback from users, and make improvements based on their input. Stay up-to-date on the latest features and functionalities offered by the CRM system and consider upgrading to newer versions as needed. This ongoing optimization will ensure that the system continues to meet the evolving needs of your business.

Key Features to Consider in a CRM for Insurance

When selecting a CRM system for your insurance business, consider these essential features:

Policy Management

The CRM should allow you to manage policy information, including coverage details, premiums, and renewal dates. It should also provide tools for generating policy quotes and managing policy applications.

Claims Tracking

The CRM should enable you to track claims from start to finish, including claim submission, investigation, and settlement. It should also provide tools for managing claim documents and communicating with claimants.

Agent Management

The CRM should provide tools for managing your insurance agents, including tracking their performance, managing their commissions, and providing them with access to customer data.

Lead Management

The CRM should help you capture and manage leads from various sources, including website forms, social media, and marketing campaigns. It should also provide tools for nurturing leads and converting them into customers.

Marketing Automation

The CRM should automate marketing tasks such as email marketing, social media posting, and lead nurturing. This will help you save time and improve the effectiveness of your marketing efforts.

Reporting and Analytics

The CRM should provide robust reporting and analytics capabilities, allowing you to track key performance indicators and identify areas for improvement. It should also provide tools for creating custom reports and dashboards.

Conclusion

Strengthening ERP flexibility with CRM is a strategic imperative for insurance companies seeking to thrive in today’s competitive landscape. By integrating these two powerful systems, insurers can gain a 360-degree view of their customers, streamline operations, and respond quickly to changing market conditions. By following the steps outlined in this guide and carefully considering the key features to look for in a CRM system, insurance companies can unlock the full potential of their ERP investment and create a more agile, customer-centric, and profitable organization. The journey requires careful planning, execution, and continuous improvement, but the rewards are well worth the effort.

Conclusion

In conclusion, integrating CRM functionalities into ERP systems within the insurance industry is no longer a luxury, but a necessity for achieving true business agility. By strategically implementing the outlined steps – from meticulous data mapping and workflow automation to leveraging cloud technologies and prioritizing user adoption – insurance providers can unlock unprecedented levels of flexibility. This translates to faster response times to market changes, improved customer satisfaction through personalized experiences, and ultimately, a stronger competitive advantage in a rapidly evolving landscape. The ability to adapt and innovate hinges on the seamless flow of information and the empowerment of employees, both of which are significantly enhanced by a well-integrated CRM–ERP solution.

The journey towards a flexible and responsive insurance system requires a commitment to continuous improvement and a willingness to embrace new technologies. As we have explored, the synergistic relationship between CRM and ERP offers a powerful pathway to achieving this goal. We encourage insurance organizations to assess their current systems and explore the potential benefits of a strategic CRM–ERP integration. As we have explored, the synergistic relationship between CRM and ERP, outlined Top Ideas To CRM Drive ERP Performance In, is crucial. Now is the time to take action and begin building a more resilient, customer-centric, and ultimately, more profitable future. Explore how a tailored CRM–ERP solution can transform your business and contact us today for a consultation: www.example.com/contact-us.

Frequently Asked Questions (FAQ) about Steps to CRM Strengthen ERP Flexibility in Insurance Systems

How does CRM improve ERP flexibility?

CRM integration centralizes customer data, allowing ERP systems to adapt quickly to changing customer needs. This enhanced data flow improves ERP flexibility and provides better insurance product customization.

What CRM data enhances ERP in insurance?

Policyholder preferences and risk profiles from CRM enable ERP systems to optimize pricing and underwriting. This also strengthens insurance claims processing efficiency through data-driven insights.

How to integrate CRM & ERP in insurance?

Start with clearly defining data flows and selecting compatible systems for seamless CRM and ERP integration. APIs and middleware are key for real-time data synchronization, enhancing insurance operations.