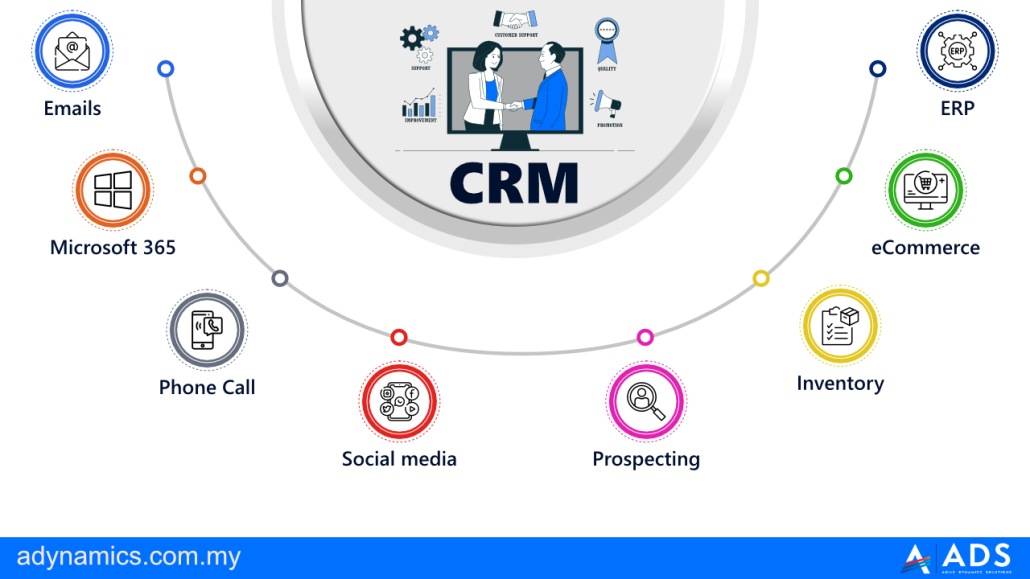

The insurance industry, traditionally reliant on complex legacy systems, is undergoing a significant transformation. Modern customers demand personalized experiences, seamless interactions, and rapid responses. To meet these demands and stay competitive, insurance providers are increasingly turning to integrated solutions that combine the power of Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP). While ERP systems streamline core operational processes, CRM focuses on building and nurturing customer relationships. The synergy between these two systems can unlock unprecedented value, particularly in optimizing insurance portfolios.

This article explores how CRM insights can enhance the value of ERP systems within insurance portfolios. We’ll delve into the key features and benefits of integrating these platforms, highlighting how data-driven decision-making, improved customer service, and streamlined workflows can lead to increased profitability and market share. We’ll also discuss the challenges involved in implementing such an integration and provide practical guidance on how to overcome them.

Ultimately, understanding the interplay between CRM and ERP is crucial for insurance companies looking to future-proof their operations. By leveraging CRM insights to inform ERP processes, insurers can create a more agile, customer-centric, and efficient organization. This guide offers a comprehensive overview of the topic, providing actionable strategies for maximizing the value of your insurance portfolio through strategic CRM–ERP integration.

Understanding the Roles of CRM and ERP in Insurance

Before diving into the integration benefits, it’s important to understand the distinct roles of CRM and ERP systems within an insurance organization. While they often overlap and share data, their primary focuses differ significantly.

Customer Relationship Management (CRM)

CRM systems are designed to manage and improve customer interactions across the entire customer lifecycle. In the insurance industry, this includes:

- Lead Generation and Management: Tracking potential customers, managing marketing campaigns, and qualifying leads.

- Policy Sales and Onboarding: Streamlining the application process, providing personalized quotes, and ensuring a smooth onboarding experience.

- Customer Service and Support: Handling inquiries, resolving issues, and providing ongoing support through various channels (phone, email, chat). These efforts often rely on Customer relationship management to succeed.

- Claims Management: Managing the claims process, from initial reporting to settlement, ensuring a timely and efficient resolution.

- Policy Renewals and Retention: Proactively engaging with customers before renewal dates, offering tailored renewal options, and minimizing churn.

Key features of a CRM system for insurance include contact management, sales automation, marketing automation, service management, and analytics dashboards.

Enterprise Resource Planning (ERP)

ERP systems, on the other hand, focus on managing the core operational processes of an insurance company. This encompasses:

- Financial Management: Managing accounting, budgeting, and financial reporting.

- Human Resources Management: Managing employee data, payroll, benefits, and training.

- Policy Administration: Managing policy data, underwriting processes, and regulatory compliance.

- Claims Processing: Automating claims processing workflows, managing payments, and detecting fraud.

- Reinsurance Management: Managing reinsurance agreements and claims.

ERP systems typically include modules for financial accounting, human capital management, supply chain management (if applicable, for things like office supplies or IT equipment), and industry-specific functionalities like policy administration and claims processing.

The Synergy: How CRM Insights Enhance ERP Value

The real power comes when CRM insights are integrated into ERP processes. This allows insurance companies to make data-driven decisions that optimize operations and improve customer satisfaction. Here are some key ways CRM enhances ERP value:

Improved Underwriting and Risk Assessment

CRM data can provide valuable insights into customer risk profiles. By integrating CRM data (e.g., customer demographics, claims history, previous interactions) with ERP systems, underwriters can gain a more comprehensive understanding of the risk associated with each policy. This can lead to more accurate pricing, reduced risk exposure, and improved profitability.

Optimized Claims Processing

CRM data can streamline the claims process by providing claims adjusters with immediate access to customer information, policy details, and previous interactions. This can help them quickly verify claims, identify potential fraud, and resolve claims more efficiently. Integrating CRM with ERP also allows for automated communication with customers throughout the claims process, keeping them informed and reducing anxiety.

Personalized Policy Recommendations and Cross-Selling

CRM data can be used to identify cross-selling and upselling opportunities. By analyzing customer data, such as their existing policies, demographics, and lifestyle, insurance companies can identify other products and services that may be of interest to them. This allows for personalized policy recommendations that are more likely to resonate with customers, increasing sales and revenue.

Enhanced Customer Service and Retention

Integrating CRM with ERP provides customer service representatives with a 360-degree view of each customer, including their policy details, claims history, and previous interactions. This enables them to provide faster, more personalized service, leading to increased customer satisfaction and loyalty. Proactive customer service, based on CRM insights (e.g., identifying customers at risk of churning), can also help improve retention rates.

Data-Driven Product Development

CRM data can provide valuable insights into customer needs and preferences. By analyzing customer feedback, market trends, and competitive offerings, insurance companies can identify opportunities to develop new products and services that better meet the evolving needs of their customers. This can lead to increased market share and revenue growth.

Key Features of a CRM–ERP Integrated Solution for Insurance

A successful CRM–ERP integration for insurance requires specific features that cater to the industry’s unique needs. These features facilitate seamless data flow and enable the realization of the benefits outlined above:

Real-Time Data Synchronization

Real-time data synchronization between CRM and ERP is crucial for ensuring that all departments have access to the most up-to-date information. This eliminates data silos and enables informed decision-making across the organization.

Automated Workflows

Automated workflows can streamline processes such as lead routing, policy application, claims processing, and policy renewals. This reduces manual effort, improves efficiency, and minimizes errors.

Customizable Dashboards and Reporting

Customizable dashboards and reporting tools provide insights into key performance indicators (KPIs) such as customer acquisition cost, customer lifetime value, claims processing time, and policy renewal rates. This allows insurance companies to track their progress and identify areas for improvement.

Role-Based Access Control

Role-based access control ensures that users only have access to the information they need to perform their jobs. This protects sensitive data and ensures compliance with regulatory requirements.

Mobile Accessibility

Mobile accessibility allows users to access CRM and ERP data from anywhere, at any time. This is particularly important for field agents and claims adjusters who need to access information while on the go.

Challenges and Considerations for CRM–ERP Integration

While the benefits of CRM–ERP integration are significant, it’s important to be aware of the challenges involved in implementing such a project. These challenges can include:

Data Migration and Cleansing

Migrating data from legacy systems to the new integrated system can be a complex and time-consuming process. It’s important to ensure that data is accurate, complete, and consistent before migrating it to the new system. Data cleansing is often necessary to remove duplicate or inaccurate data.

System Compatibility

Ensuring that the CRM and ERP systems are compatible with each other is crucial for a successful integration. This may require customizing the systems or using integration middleware to bridge the gap between them.

User Adoption

Getting users to adopt the new integrated system can be a challenge. It’s important to provide adequate training and support to users and to communicate the benefits of the new system clearly.

Cost and Complexity

CRM–ERP integration can be a costly and complex project. It’s important to carefully plan the project and to allocate sufficient resources to ensure its success.

Best Practices for Successful CRM–ERP Integration

To overcome these challenges and ensure a successful CRM–ERP integration, consider the following best practices:

- Define clear goals and objectives. What do you hope to achieve with the integration? What KPIs will you track to measure success?

- Develop a detailed project plan. Outline the scope of the project, the timeline, the resources required, and the risks involved.

- Choose the right integration approach. Consider different integration options, such as point-to-point integration, middleware integration, or cloud-based integration platforms.

- Involve key stakeholders. Get input from all departments that will be affected by the integration.

- Provide adequate training and support. Ensure that users are properly trained on the new system and have access to ongoing support.

- Monitor and measure results. Track key performance indicators (KPIs) to measure the success of the integration and identify areas for improvement.

Conclusion: Unlocking the Full Potential of Your Insurance Portfolio

In conclusion, integrating CRM and ERP systems offers a powerful way for insurance companies to enhance the value of their portfolios. By leveraging CRM insights to inform ERP processes, insurers can improve underwriting and risk assessment, optimize claims processing, personalize policy recommendations, enhance customer service, and drive data-driven product development. While the integration process can present challenges, following best practices and carefully planning the project can lead to significant benefits in terms of increased profitability, improved customer satisfaction, and enhanced competitiveness. Embracing this integrated approach is no longer a luxury, but a necessity for insurance companies seeking to thrive in today’s dynamic market.

Conclusion

In conclusion, integrating CRM insights into ERP systems represents a significant opportunity for insurance companies to unlock substantial value within their portfolios. By leveraging the rich customer data captured in CRM, organizations can optimize ERP functionalities, leading to improved operational efficiency, enhanced risk management, and ultimately, a more customer-centric approach. This synergy allows for a deeper understanding of customer needs and preferences, enabling insurers to tailor products and services more effectively, personalize interactions, and proactively address potential issues. The strategic alignment of these two critical systems moves beyond mere data sharing, fostering a holistic view of the customer journey and driving a competitive advantage in an increasingly demanding market.

The journey toward maximizing ERP value through CRM insights requires a commitment to data governance, process optimization, and a willingness to embrace a collaborative culture between sales, marketing, and operations teams. As the insurance landscape continues to evolve, those organizations that prioritize the integration of these systems will be best positioned to thrive. We encourage insurance leaders to explore the potential of CRM–ERP integration within their own organizations and consider how these insights can drive tangible improvements in profitability, customer satisfaction, and overall business performance. Take the first step today and contact our team to discover how a tailored CRM–ERP strategy can transform your insurance portfolio.

Frequently Asked Questions (FAQ) about CRM Insights to Enhance ERP Value in Insurance Portfolios

How does CRM improve ERP in insurance?

CRM data enriches ERP by providing customer insights. This allows for better forecasting, personalized service, and targeted product development. Ultimately, improved customer understanding drives more efficient resource allocation in the ERP.

What CRM data enhances insurance ERP?

Customer lifetime value, claims history, and policy preferences from CRM are key. This CRM data helps ERP systems optimize pricing, reduce fraud, and personalize insurance product offerings, leading to better business decisions.

Why integrate CRM and ERP for insurance?

Integrating CRM and ERP streamlines insurance operations. This integration improves data accuracy, eliminates redundancies, and enhances decision-making across sales, service, and finance, optimizing resource utilization and profitability.