In the dynamic and highly competitive insurance industry, efficiency is paramount. From managing policies and processing claims to nurturing customer relationships, insurance operations are complex and require seamless coordination. Enterprise Resource Planning (ERP) systems and Customer Relationship Management (CRM) systems are powerful tools that, when integrated effectively, can significantly enhance operational efficiency. However, simply implementing these systems isn’t enough. To truly reap the benefits, insurance companies need to adopt best practices that ensure these systems work synergistically.

This article delves into the best practices for leveraging CRM to support ERP efficiency in insurance operations. We’ll explore the key features of both CRM and ERP systems, understand how they interact, and outline specific strategies that insurance companies can implement to optimize their operations. We’ll also look at common challenges and offer practical solutions to overcome them. The ultimate goal is to provide a comprehensive guide that empowers insurance professionals to make informed decisions and drive tangible improvements in their organizations.

Think of this as a roadmap. We’ll navigate the complexities of CRM and ERP integration, focusing on real-world applications and actionable insights. Whether you’re a seasoned IT professional, a business leader, or simply curious about how these technologies can transform insurance operations, this guide will provide you with the knowledge and tools you need to succeed. We’ll also explore strategies, similar to those discussed in CRM Insights To Enhance ERP Value In Insurance. Let’s embark on this journey to unlock the full potential of CRM and ERP in the insurance industry.

Understanding CRM and ERP in the Insurance Context

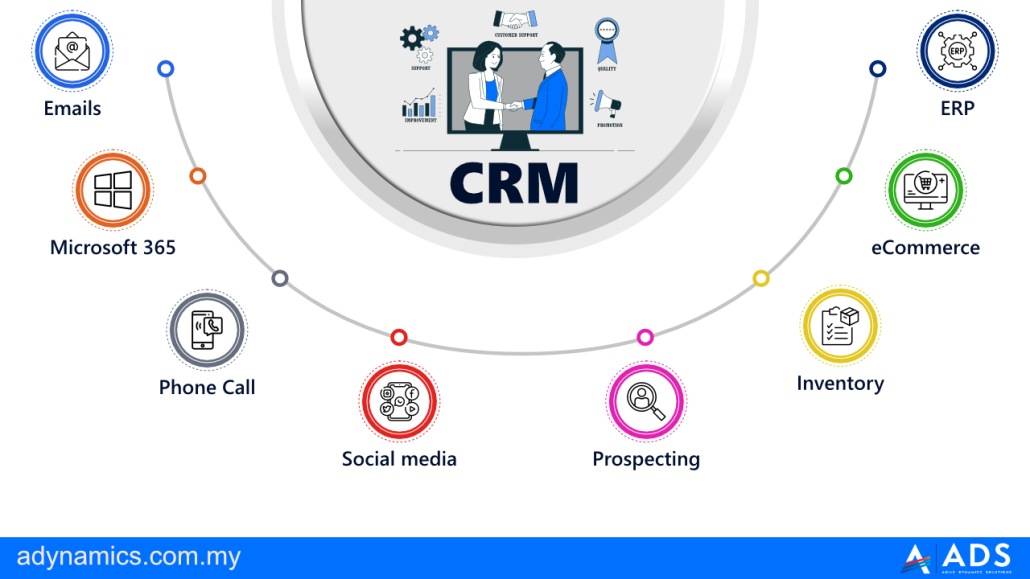

Before diving into best practices, it’s crucial to understand the core functions of CRM and ERP systems and how they relate to insurance operations. While both systems aim to improve efficiency and productivity, they focus on different aspects of the business. CRM primarily manages customer interactions and relationships, while ERP integrates and automates internal business processes.

Key Features of CRM Systems for Insurance

In the insurance industry, a CRM system acts as a central hub for managing customer data and interactions. Its key features include:

- Contact Management: Storing and organizing customer information, including contact details, policy history, and communication logs.

- Lead Management: Tracking and nurturing potential customers (leads) through the sales process, from initial inquiry to policy purchase.

- Sales Automation: Automating repetitive tasks, such as sending follow-up emails and scheduling appointments, allowing agents to focus on building relationships and closing deals.

- Marketing Automation: Creating and executing targeted marketing campaigns to attract new customers and retain existing ones.

- Customer Service: Providing tools for managing customer inquiries, complaints, and claims, ensuring timely and efficient resolution.

- Reporting and Analytics: Generating reports and dashboards to track key performance indicators (KPIs), such as customer acquisition cost, retention rate, and sales performance.

Key Features of ERP Systems for Insurance

An ERP system integrates various internal business functions, such as finance, accounting, human resources, and operations. In the context of insurance, its key features include:

- Policy Administration: Managing policy issuance, renewals, cancellations, and endorsements.

- Claims Management: Processing and managing insurance claims, from initial filing to settlement.

- Financial Management: Handling financial transactions, including premium billing, commission payments, and expense tracking.

- Accounting: Managing general ledger, accounts payable, and accounts receivable.

- Compliance Management: Ensuring adherence to regulatory requirements and industry standards.

- Reporting and Analytics: Providing insights into financial performance, operational efficiency, and risk management.

Why CRM and ERP Integration is Crucial for Insurance

Integrating CRM and ERP systems is essential for creating a unified view of the customer and streamlining insurance operations. Without integration, data silos can emerge, leading to inconsistencies, inefficiencies, and poor customer experiences. Here’s why integration is so important:

- Improved Customer Experience: Integration allows agents to access a complete view of the customer, including their policy history, claims status, and interaction logs. This enables them to provide personalized and efficient service.

- Increased Sales Productivity: By automating lead management and sales processes, integration frees up agents to focus on building relationships and closing deals.

- Streamlined Claims Processing: Integration enables seamless data flow between the CRM and ERP systems, accelerating claims processing and reducing errors.

- Enhanced Decision-Making: Integration provides a holistic view of the business, enabling managers to make informed decisions based on accurate and up-to-date data.

- Reduced Operational Costs: By automating tasks and eliminating data silos, integration can significantly reduce operational costs.

Best Practices for CRM Support ERP Efficiency

Now that we understand the importance of CRM and ERP integration, let’s explore the best practices for leveraging CRM to support ERP efficiency in insurance operations. These practices cover various aspects of the integration process, from planning and implementation to ongoing maintenance and optimization.

1. Define Clear Business Objectives

Before embarking on a CRM and ERP integration project, it’s crucial to define clear business objectives. What specific goals do you want to achieve? Do you want to improve customer satisfaction, increase sales, streamline claims processing, or reduce operational costs? Clearly defining your objectives will help you prioritize your efforts and measure your success.

For example, an insurance company might set the following objectives:

- Reduce claims processing time by 20%.

- Increase customer retention rate by 10%.

- Improve lead conversion rate by 15%.

2. Choose the Right Integration Approach

There are several approaches to integrating CRM and ERP systems, ranging from simple point-to-point integrations to more complex enterprise service bus (ESB) architectures. The best approach depends on the specific needs and resources of your organization. Consider the following factors:

- Complexity of the Integration: How many data fields need to be integrated? How complex are the business processes that need to be automated?

- Scalability: Will the integration solution be able to handle future growth and changes in your business? Complexity also ties into Best Tips To CRM Upgrade ERP Modules In for a successful project.

- Cost: How much will it cost to implement and maintain the integration solution?

- Technical Expertise: Do you have the internal technical expertise to implement and maintain the integration solution?

Common integration approaches include:

- Point-to-Point Integration: A direct connection between the CRM and ERP systems. This is a simple and cost-effective approach for basic integrations.

- Middleware Integration: Using a middleware platform to facilitate data exchange between the CRM and ERP systems. This approach provides greater flexibility and scalability.

- Cloud-Based Integration Platform as a Service (iPaaS): Using a cloud-based platform to integrate the CRM and ERP systems. This approach offers ease of use and scalability.

3. Ensure Data Consistency and Accuracy

Data consistency and accuracy are critical for successful CRM and ERP integration. Inconsistent or inaccurate data can lead to errors, inefficiencies, and poor decision-making. Implement data validation rules and data cleansing processes to ensure that data is accurate and consistent across both systems.

Consider the following:

- Data Mapping: Carefully map data fields between the CRM and ERP systems to ensure that data is correctly transferred.

- Data Validation: Implement data validation rules to prevent invalid data from being entered into the systems.

- Data Cleansing: Regularly cleanse data to remove duplicates, correct errors, and ensure data accuracy.

4. Automate Business Processes

Automation is key to maximizing the benefits of CRM and ERP integration. Automate repetitive tasks and business processes to improve efficiency, reduce errors, and free up employees to focus on more strategic activities. Examples of processes to automate include:

- Lead Qualification: Automatically qualify leads based on predefined criteria and route them to the appropriate sales agents.

- Policy Issuance: Automatically generate policy documents and send them to customers upon approval.

- Claims Processing: Automatically update the customer’s CRM record with claims information from the ERP system.

- Commission Payments: Automatically calculate and process commission payments based on sales performance data from the CRM system and financial data from the ERP system.

5. Provide Comprehensive Training

Even the best CRM and ERP integration solution will fail if employees don’t know how to use it effectively. Provide comprehensive training to all users on how to use the integrated system. Training should cover both the CRM and ERP systems and how they interact with each other. Tailor the training to the specific roles and responsibilities of each user.

Consider the following:

- Role-Based Training: Provide training that is tailored to the specific needs of each user role.

- Hands-On Training: Provide hands-on training that allows users to practice using the integrated system.

- Ongoing Training: Provide ongoing training to keep users up-to-date on new features and functionality.

6. Monitor and Optimize Performance

CRM and ERP integration is an ongoing process, not a one-time event. Continuously monitor the performance of the integrated system and make adjustments as needed to optimize its effectiveness. Track key performance indicators (KPIs) to measure the success of the integration and identify areas for improvement.

Consider the following:

- Performance Monitoring: Regularly monitor the performance of the integrated system to identify bottlenecks and areas for improvement.

- User Feedback: Solicit feedback from users to identify areas where the integrated system can be improved.

- Continuous Improvement: Continuously improve the integrated system based on performance monitoring and user feedback.

Common Challenges and How to Overcome Them

Implementing CRM and ERP integration in insurance operations can be challenging. Here are some common challenges and how to overcome them:

- Data Migration: Migrating data from legacy systems to the new integrated system can be complex and time-consuming. Solution: Plan the data migration carefully and use data migration tools to automate the process.

- Resistance to Change: Employees may resist using the new integrated system, especially if they are comfortable with the old ways of doing things. Solution: Communicate the benefits of the integration to employees and provide comprehensive training.

- Integration Complexity: Integrating complex CRM and ERP systems can be technically challenging. Solution: Choose the right integration approach and partner with experienced integration specialists.

- Budget Constraints: CRM and ERP integration can be expensive. Solution: Develop a realistic budget and prioritize the most important integration features.

Conclusion

By implementing these best practices, insurance companies can leverage CRM to significantly support ERP efficiency, leading to improved customer experiences, increased sales productivity, streamlined claims processing, enhanced decision-making, and reduced operational costs. Remember that CRM and ERP integration is not just a technical project; it’s a strategic initiative that requires careful planning, execution, and ongoing optimization. By embracing these best practices, insurance companies can unlock the full potential of CRM and ERP and achieve a competitive advantage in today’s dynamic market.

Conclusion

In conclusion, integrating CRM support with ERP systems is no longer a luxury but a necessity for insurance operations aiming for optimal efficiency. Throughout this article, we have highlighted how strategic implementation of these best practices, from data synchronization and workflow automation to enhanced communication and customer-centric insights, can significantly streamline processes, reduce operational costs, and improve overall business performance. The synergistic relationship between CRM and ERP allows insurance companies to move beyond siloed operations and cultivate a unified, data-driven approach to managing every aspect of their business.

By embracing these best practices and fostering a culture of continuous improvement, insurance companies can unlock the full potential of their CRM and ERP investments. The result is not only a more efficient and profitable organization but also a superior customer experience, leading to increased loyalty and a stronger competitive advantage. We encourage insurance providers to assess their current CRM and ERP integration strategies and explore opportunities to implement these recommendations. Here’s a possible sentence: Steps To CRM Automate ERP Functions For Insurance To learn more about specific solutions and how they can be tailored to your unique needs, we invite you to contact our team of experts for a personalized consultation.

Frequently Asked Questions (FAQ) about Best Practices to CRM Support ERP Efficiency in Insurance Operations

How does CRM improve insurance ERP efficiency?

CRM streamlines data flow to ERP. Integrating CRM with ERP ensures accurate client data for policy management and claims processing. This reduces errors and speeds up operations.

What CRM data should sync with ERP in insurance?

Sync client contact information, policy details, and claims data. This ensures ERP systems have real-time updates for accurate financial reporting and customer service. Accurate data improves efficiency.

Why is CRM training important for ERP efficiency?

Training ensures staff use CRM correctly, feeding accurate data to ERP. Proper training minimizes data entry errors and maximizes the benefits of integrated systems. This improves overall process efficiency.