In the insurance industry, efficiency and customer satisfaction are paramount. However, many insurance companies struggle with disconnected departments, leading to data silos, inconsistent customer experiences, and operational inefficiencies. Imagine a customer calls to update their address. The claims department has one address, the billing department another, and the sales team a third – a recipe for frustration and potential compliance issues. The key to bridging these gaps lies in integrating your Customer Relationship Management (CRM) system with your Enterprise Resource Planning (ERP) system.

This integration isn’t just about connecting two software platforms; it’s about creating a unified view of the customer and streamlining processes across the entire organization. By linking CRM and ERP, insurance companies can ensure that all departments have access to the same accurate and up-to-date information, leading to improved communication, faster response times, and a more personalized customer experience. It’s about breaking down those data silos and fostering a collaborative environment where every department works in concert.

This article will delve into how CRM connects ERP systems across insurance departments, exploring the benefits, features, and practical considerations of this powerful integration. We’ll discuss the specific advantages for different departments within an insurance company, the key features to look for in a CRM–ERP integration solution, and the steps involved in a successful implementation. Consider this your complete guide to understanding and leveraging the transformative power of CRM–ERP integration in the insurance industry. This article will delve into how CRM connects ERP systems across insurance departments, exploring the benefits, features, and practical considerations of this powerful integration. We’ll discuss the steps, similar to Steps To CRM Automate ERP Functions For Insurance, involved.

Understanding the Role of CRM and ERP in Insurance

Before diving into the integration process, it’s important to understand the distinct roles of CRM and ERP systems within an insurance organization. While both systems handle critical business functions, they focus on different aspects of the operation.

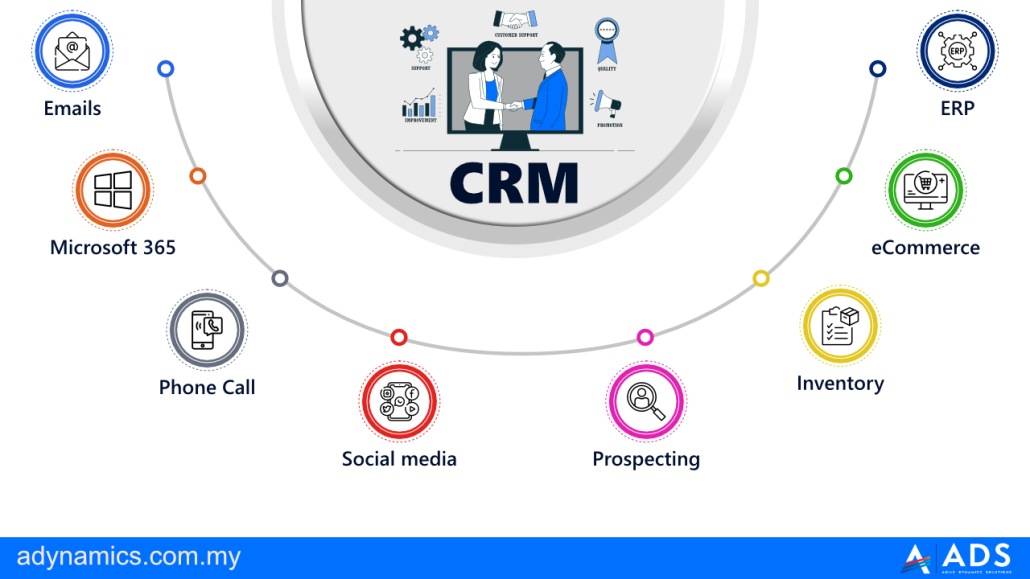

What is CRM?

CRM, or Customer Relationship Management, is a system designed to manage and analyze customer interactions and data throughout the customer lifecycle. In the insurance context, CRM is used to:

- Manage Leads and Prospects: Track potential customers and nurture them through the sales pipeline.

- Manage Customer Accounts: Maintain detailed records of policyholders, including contact information, policy details, and interaction history.

- Track Customer Interactions: Record all communication with customers, including phone calls, emails, and online interactions. Managing these processes effectively, including How To CRM Align ERP Implementation For Insurance, is crucial.

- Provide Customer Service: Manage customer inquiries, complaints, and requests.

- Analyze Customer Data: Identify trends, patterns, and insights to improve customer satisfaction and retention.

Ultimately, CRM is all about building and maintaining strong relationships with customers. It provides a 360-degree view of the customer, enabling insurance companies to deliver personalized service and anticipate customer needs.

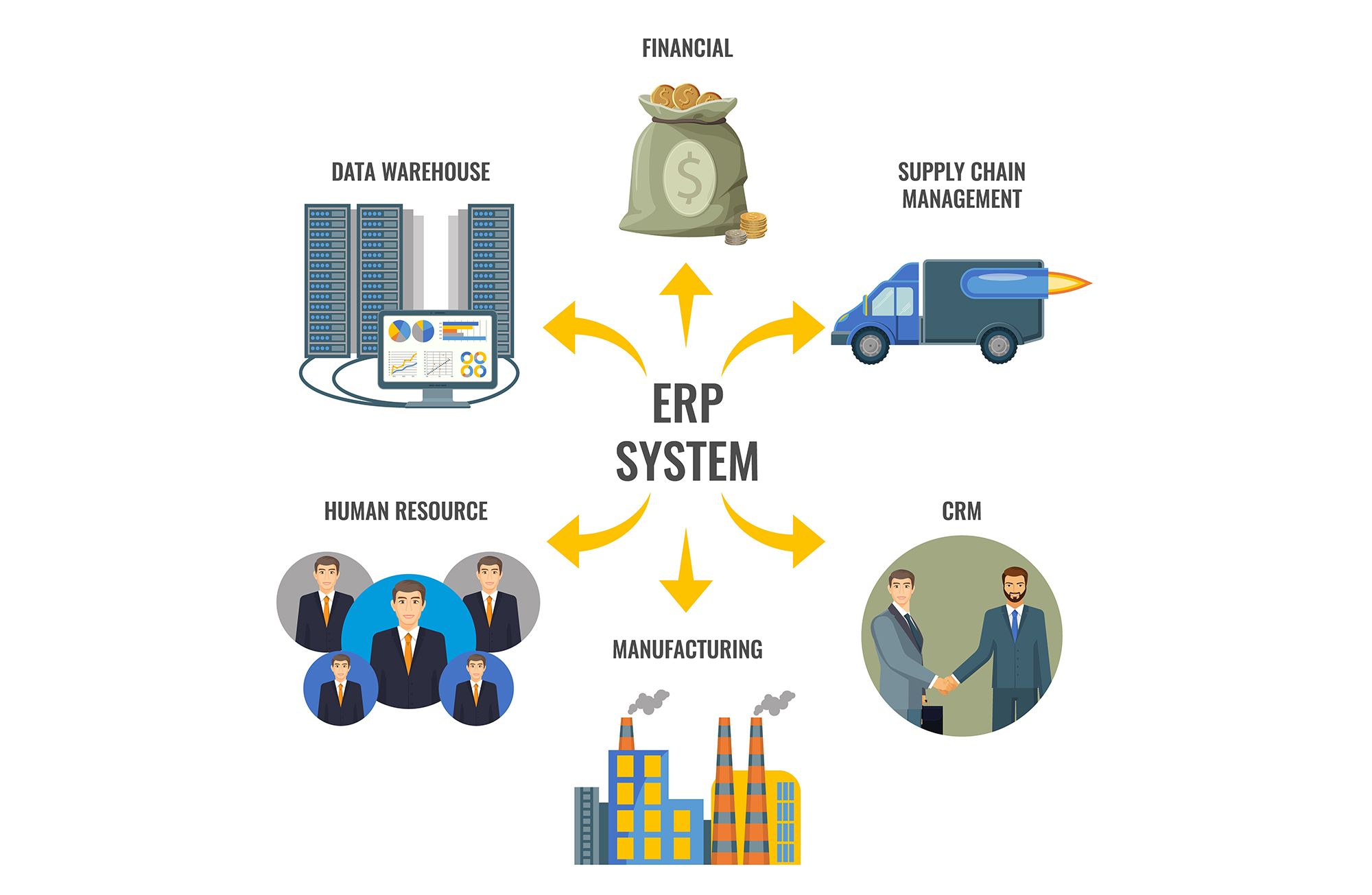

What is ERP?

ERP, or Enterprise Resource Planning, is a system that integrates all facets of a business, including planning, manufacturing, sales, marketing, finance, human resources, and more. In the insurance context, ERP is used to:

- Manage Policy Administration: Automate policy issuance, renewal, and cancellation processes.

- Manage Claims Processing: Streamline the claims process from initial filing to final settlement.

- Manage Billing and Payments: Automate billing cycles, track payments, and manage accounts receivable. Furthermore, improve Customer relationship management by centralizing data.

- Manage Financial Accounting: Track financial transactions, generate financial reports, and ensure compliance with regulations.

- Manage Human Resources: Manage employee data, payroll, and benefits.

ERP is focused on operational efficiency and resource management. It provides a centralized platform for managing core business processes, reducing manual tasks, and improving data accuracy.

The Benefits of CRM–ERP Integration in Insurance

Integrating CRM and ERP systems offers a multitude of benefits for insurance companies, impacting various departments and ultimately improving the bottom line.

Improved Customer Experience

By providing a unified view of the customer, CRM–ERP integration enables insurance companies to deliver a more personalized and consistent customer experience. Agents can access policy information, claims history, and billing details directly from the CRM system, allowing them to quickly answer customer inquiries and resolve issues. This leads to increased customer satisfaction and loyalty.

Streamlined Claims Processing

Integrating CRM with the ERP claims module streamlines the claims process, reducing processing time and improving accuracy. Claims adjusters can access customer information and policy details directly from the CRM system, eliminating the need to manually search for information in multiple systems. This allows them to focus on resolving claims quickly and efficiently.

Enhanced Sales and Marketing Effectiveness

CRM–ERP integration provides valuable insights into customer behavior and preferences, enabling insurance companies to target their marketing efforts more effectively. Sales teams can access policy information and claims history from the ERP system, allowing them to identify cross-selling and upselling opportunities. Marketing campaigns can be tailored to specific customer segments based on their policy details and claims history.

Improved Operational Efficiency

By automating data sharing and eliminating manual tasks, CRM–ERP integration improves operational efficiency across the organization. Data entry errors are reduced, and employees can spend less time searching for information and more time focusing on value-added activities. This leads to increased productivity and reduced operational costs.

Better Data Visibility and Reporting

Integrating CRM and ERP systems provides a single source of truth for customer and operational data. This enables insurance companies to generate comprehensive reports and dashboards that provide valuable insights into business performance. Management can use this data to make informed decisions and improve strategic planning.

How CRM Connects ERP Systems Across Insurance Departments

The true power of CRM–ERP integration lies in its ability to connect different departments within an insurance company, breaking down data silos and fostering collaboration.

Sales and Underwriting

By integrating CRM with ERP, sales representatives have immediate access to policy details, underwriting guidelines, and pricing information. This enables them to quickly generate quotes, assess risk, and close deals. The integration also allows for automated lead assignment and tracking, ensuring that no potential customer falls through the cracks.

Claims and Customer Service

Claims adjusters can access customer information, policy details, and claims history directly from the CRM system. This allows them to quickly verify coverage, assess damages, and process claims efficiently. Customer service representatives can also use the CRM system to answer customer inquiries, resolve complaints, and provide updates on claims status.

Billing and Finance

Integrating CRM with the ERP billing module automates the billing process, reducing manual tasks and improving accuracy. Billing cycles can be triggered automatically based on policy terms, and payment information can be securely stored in the ERP system. The integration also allows for automated reconciliation of payments and accounts receivable.

Marketing and Product Development

CRM–ERP integration provides valuable insights into customer behavior and preferences, enabling marketing teams to target their efforts more effectively. Product development teams can use this data to identify new product opportunities and tailor existing products to meet customer needs.

Key Features to Look for in a CRM–ERP Integration Solution

Choosing the right CRM–ERP integration solution is crucial for success. Here are some key features to look for:

Real-time Data Synchronization

The integration solution should provide real-time data synchronization between CRM and ERP systems, ensuring that all departments have access to the most up-to-date information.

Customizable Workflows

The solution should allow for the creation of customizable workflows that automate business processes and improve efficiency.

Role-Based Access Control

The solution should provide role-based access control, ensuring that employees only have access to the information they need.

Reporting and Analytics

The solution should provide comprehensive reporting and analytics capabilities, enabling insurance companies to track key performance indicators and identify areas for improvement.

Scalability and Flexibility

The solution should be scalable and flexible, able to adapt to the changing needs of the insurance company.

Implementing CRM–ERP Integration: A Step-by-Step Guide

Implementing CRM–ERP integration can be a complex project, but following a structured approach can help ensure success.

Step 1: Define Your Goals and Objectives

Clearly define your goals and objectives for the integration project. What specific business problems are you trying to solve? What improvements are you hoping to achieve?

Step 2: Choose the Right Integration Solution

Carefully evaluate different CRM–ERP integration solutions and choose the one that best meets your needs. Consider factors such as functionality, cost, and ease of use.

Step 3: Develop an Implementation Plan

Develop a detailed implementation plan that outlines the steps involved in the integration process, including timelines, resources, and responsibilities.

Step 4: Configure and Customize the Systems

Configure and customize the CRM and ERP systems to ensure they are properly integrated. This may involve mapping data fields, creating custom workflows, and setting up security permissions.

Step 5: Test and Validate the Integration

Thoroughly test and validate the integration to ensure that it is working correctly. This may involve running test cases, performing user acceptance testing, and monitoring system performance.

Step 6: Train Your Users

Provide training to your users on how to use the integrated CRM and ERP systems. This will help ensure that they are able to take full advantage of the new capabilities.

Step 7: Monitor and Maintain the Integration

Continuously monitor and maintain the integration to ensure that it is working properly. This may involve performing regular system checks, updating software, and addressing any issues that arise.

Conclusion

CRM–ERP integration is a powerful tool that can transform the way insurance companies operate. By connecting different departments, streamlining processes, and providing a unified view of the customer, this integration enables insurance companies to improve customer satisfaction, increase efficiency, and drive growth. While the implementation process can be complex, the benefits of a successful integration far outweigh the challenges. By carefully planning and executing the integration, insurance companies can unlock the full potential of their CRM and ERP systems and achieve significant improvements in business performance.

Conclusion

In conclusion, the strategic integration of CRM and ERP systems across insurance departments represents a paradigm shift towards enhanced operational efficiency, improved customer experiences, and a more unified view of the business. By bridging the gaps between sales, underwriting, claims, and policy administration, insurers can leverage a holistic data ecosystem to make informed decisions, streamline workflows, and ultimately, gain a competitive edge in a rapidly evolving market. This interconnectedness fosters better communication, reduces data silos, and empowers employees with the right information at the right time, leading to increased productivity and profitability.

The benefits of connecting CRM and ERP systems are undeniable, offering a pathway to optimized processes and superior customer service. As the insurance landscape becomes increasingly digitized, embracing this integration is no longer a luxury, but a necessity for survival and growth. To learn more about how your insurance organization can benefit from a seamlessly integrated CRM and ERP solution, we encourage you to contact our team of experts for a personalized consultation and discover how we can help you unlock the full potential of your data. This integration, explored further in CRM Insights To Enhance ERP Value In Insurance, is vital.

Frequently Asked Questions (FAQ) about How CRM Connects ERP Systems Across Insurance Departments

Why connect CRM to ERP in insurance?

Connecting CRM and ERP improves efficiency. It creates a unified view of customers, streamlining processes across sales, underwriting, and claims departments. This integration reduces data silos and enhances customer service.

How does CRM-ERP integration benefit insurance?

CRM–ERP integration centralizes data. This allows for better decision-making, improved sales forecasting, and more personalized customer experiences. It also automates tasks, freeing up staff for higher-value activities.

What data is shared between CRM and ERP?

Common data shared includes customer information, policy details, and billing information. The CRM may access ERP data on claims history and payment status, while the ERP benefits from CRM sales data and customer interactions.