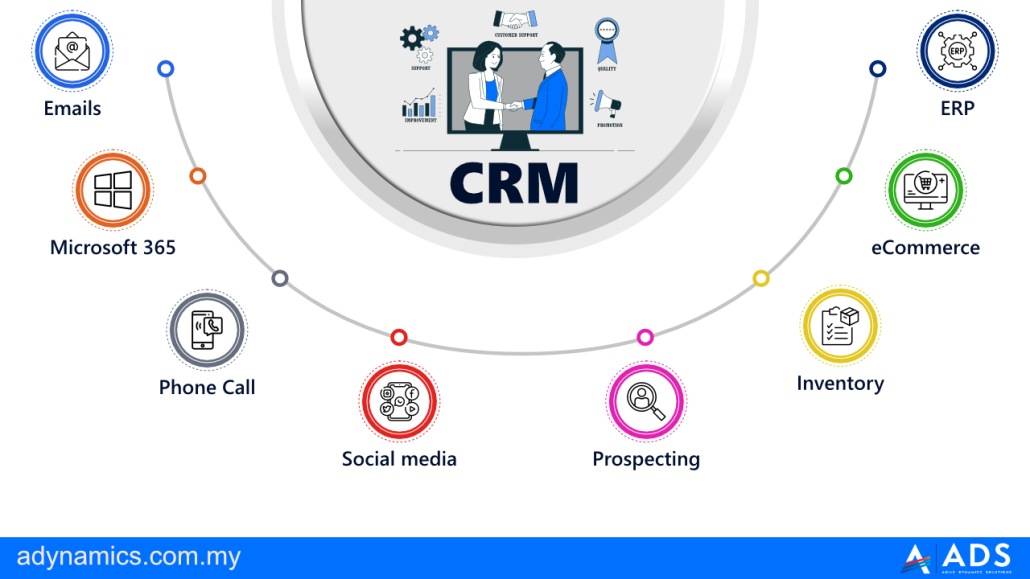

In the fast-paced world of insurance, staying ahead of the curve requires not just offering competitive products but also streamlining internal processes. Integrating various business systems, particularly Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP), is crucial for achieving this. However, the complexities of these systems often make integration a daunting task. This is where a strategic approach, leveraging the capabilities of CRM, can significantly simplify the ERP integration process, especially within the unique context of insurance companies.

For insurance companies, the synergy between CRM and ERP is particularly potent. CRM systems excel at managing customer interactions, sales pipelines, and marketing campaigns, while ERP systems handle core operational functions such as finance, policy administration, claims processing, and regulatory compliance. When these two systems work in harmony, insurance companies can achieve a 360-degree view of their customers and operations, leading to improved efficiency, enhanced customer satisfaction, and better decision-making.

This article delves into how CRM acts as a facilitator for easier ERP integration in insurance companies. We’ll explore the key features of CRM that make this possible, the specific benefits that arise from a successful integration, and the steps involved in achieving seamless data flow between these critical systems. We’ll also address common challenges and provide practical guidance to ensure your insurance company can successfully navigate the integration process and reap the rewards of a unified CRM–ERP ecosystem.

Understanding the Core Challenges of ERP Integration in Insurance

Integrating ERP systems is rarely a walk in the park, regardless of the industry. However, insurance companies face unique challenges that can make the process particularly complex. These challenges often stem from the industry’s regulatory landscape, the diverse range of products offered, and the sheer volume of data involved.

Data Silos and Inconsistent Information

One of the biggest hurdles is the existence of data silos. Different departments, such as sales, underwriting, claims, and finance, often operate with their own separate systems and databases. This leads to inconsistent information, redundant data entry, and a lack of a unified view of the customer. For example, a customer’s contact information might be updated in the CRM system but not reflected in the policy administration system, leading to communication errors and inefficiencies.

Complex Regulatory Requirements

The insurance industry is heavily regulated, and ERP systems must comply with various regulatory requirements, such as data privacy laws (e.g., GDPR, CCPA) and financial reporting standards. Integrating ERP with other systems, including CRM, requires careful consideration of these regulations to ensure compliance and avoid potential penalties. This often involves implementing robust security measures and data governance policies.

Legacy Systems and Technological Debt

Many insurance companies rely on legacy systems that are outdated and difficult to integrate with modern technologies. These systems often lack open APIs and standard data formats, making it challenging to establish seamless data exchange with ERP. Addressing technological debt and modernizing legacy systems can be a significant undertaking, but it’s often a necessary step towards successful ERP integration.

Resistance to Change and Lack of User Adoption

Implementing a new ERP system or integrating it with existing systems can be disruptive, and employees may resist the change. Proper training and change management are essential to ensure user adoption and maximize the benefits of the integrated system. It’s important to involve users in the planning and implementation process to address their concerns and ensure the system meets their needs.

How CRM Facilitates Easier ERP Integration

CRM systems, when strategically implemented, can act as a bridge between different systems, including ERP, making the integration process smoother and more efficient. Here’s how:

Centralized Customer Data Hub

CRM serves as a central repository for all customer-related data, including contact information, policy details, interaction history, and preferences. By consolidating this information in one place, CRM eliminates data silos and provides a single source of truth for the entire organization. This centralized data hub simplifies the process of mapping data between CRM and ERP, reducing the risk of errors and inconsistencies.

Standardized Data Formats and APIs

Modern CRM systems typically offer standardized data formats and APIs (Application Programming Interfaces) that facilitate seamless integration with other systems, including ERP. These APIs allow for real-time data exchange between CRM and ERP, ensuring that information is always up-to-date and accurate. This reduces the need for custom coding and simplifies the integration process.

Workflow Automation and Business Process Management

CRM systems often include workflow automation and business process management (BPM) capabilities that can streamline business processes and improve efficiency. By automating tasks such as lead generation, policy quoting, and claims processing, CRM can reduce manual data entry and improve data accuracy. This, in turn, simplifies the integration with ERP, as the data being exchanged is more consistent and reliable.

Enhanced Reporting and Analytics

CRM systems provide powerful reporting and analytics capabilities that can provide valuable insights into customer behavior and business performance. By integrating CRM with ERP, insurance companies can gain a comprehensive view of their operations, from sales and marketing to finance and claims. This allows them to identify areas for improvement and make data-driven decisions.

Key CRM Features That Simplify ERP Integration

Certain CRM features are particularly helpful in simplifying ERP integration for insurance companies. These features act as enablers, smoothing the path to a connected and efficient system.

Data Mapping and Transformation Tools

These tools allow you to define how data fields in CRM correspond to data fields in ERP. This ensures that data is accurately transferred between the two systems, even if the field names or data formats are different. Transformation capabilities allow you to convert data from one format to another, ensuring compatibility between CRM and ERP.

Integration Platform as a Service (iPaaS) Support

iPaaS solutions provide a cloud-based platform for connecting different applications and systems. They offer pre-built connectors and integration templates that simplify the integration process and reduce the need for custom coding. Many modern CRM systems integrate seamlessly with iPaaS platforms, making it easier to connect them to ERP systems.

Real-Time Data Synchronization

Real-time data synchronization ensures that data is updated in both CRM and ERP systems as soon as it changes. This eliminates the need for batch processing and ensures that everyone has access to the most up-to-date information. This is crucial for making timely decisions and providing excellent customer service.

Customizable APIs and Web Services

Customizable APIs and web services allow you to tailor the integration to your specific needs. You can define the data that is exchanged, the frequency of the synchronization, and the business rules that are applied. This gives you greater control over the integration process and ensures that it meets your unique requirements.

Benefits of CRM–ERP Integration in Insurance

The benefits of a well-integrated CRM–ERP system in the insurance industry are numerous and far-reaching. They impact nearly every facet of the business, from customer acquisition to operational efficiency.

Improved Customer Experience

With a unified view of the customer, insurance companies can provide more personalized and responsive service. Agents can access policy information, claims history, and interaction history from a single system, allowing them to quickly resolve customer inquiries and provide tailored advice. This leads to increased customer satisfaction and loyalty.

Enhanced Operational Efficiency

By automating business processes and eliminating manual data entry, CRM–ERP integration can significantly improve operational efficiency. Claims processing can be streamlined, policy renewals can be automated, and financial reporting can be generated more quickly and accurately. This frees up employees to focus on more strategic tasks.

Better Decision-Making

With access to comprehensive data from both CRM and ERP, insurance companies can make more informed decisions. They can identify trends in customer behavior, optimize pricing strategies, and improve risk management. This leads to better financial performance and increased profitability.

Increased Sales and Revenue

By providing sales teams with a 360-degree view of the customer and automating sales processes, CRM–ERP integration can help increase sales and revenue. Agents can identify cross-selling and upselling opportunities, track leads more effectively, and close deals faster. This leads to increased market share and revenue growth.

Steps to Successful CRM–ERP Integration in Insurance

Successfully integrating CRM and ERP requires careful planning and execution. Here’s a step-by-step guide to help you navigate the process:

- Define Your Integration Goals: Clearly define what you want to achieve with the integration. What business problems are you trying to solve? What metrics will you use to measure success?

- Assess Your Existing Systems: Evaluate your current CRM and ERP systems to identify their strengths and weaknesses. Determine which data needs to be integrated and how.

- Choose the Right Integration Approach: Consider different integration approaches, such as direct integration, middleware integration, or iPaaS integration. Choose the approach that best fits your needs and budget.

- Develop a Data Mapping Strategy: Create a detailed data mapping strategy that defines how data fields in CRM will correspond to data fields in ERP. Ensure that data is accurately transformed and validated.

- Implement the Integration: Implement the integration according to your chosen approach. This may involve custom coding, configuring pre-built connectors, or using an iPaaS platform.

- Test the Integration Thoroughly: Test the integration thoroughly to ensure that data is accurately transferred and that all business processes are working correctly.

- Train Your Users: Provide comprehensive training to your users on how to use the integrated system. Ensure that they understand the benefits of the integration and how it will improve their work.

- Monitor and Maintain the Integration: Continuously monitor the integration to ensure that it is working correctly. Address any issues that arise and make adjustments as needed.

Common Challenges and How to Overcome Them

Even with careful planning, you may encounter challenges during CRM–ERP integration. Here are some common challenges and how to overcome them:

Data Quality Issues

Challenge: Inaccurate or inconsistent data can lead to errors and inefficiencies in the integrated system.

Solution: Implement data cleansing and validation processes to ensure data quality. Establish data governance policies to prevent data corruption. Furthermore, this improves Customer relationship management through reliable data.

Lack of Technical Expertise

Challenge: Integrating CRM and ERP requires specialized technical skills.

Solution: Partner with a qualified integration vendor or hire experienced IT professionals.

Budget Constraints

Challenge: CRM–ERP integration can be expensive.

Solution: Develop a detailed budget and prioritize integration efforts. Consider using cloud-based solutions to reduce upfront costs.

Scope Creep

Challenge: The scope of the integration project can expand beyond the initial plan.

Solution: Clearly define the scope of the project and manage change requests carefully. Use a phased approach to implement the integration in manageable steps.

Conclusion

CRM plays a crucial role in simplifying ERP integration for insurance companies. By acting as a centralized customer data hub, providing standardized APIs, and offering workflow automation capabilities, CRM makes it easier to connect different systems and streamline business processes. A successful CRM–ERP integration can lead to improved customer experience, enhanced operational efficiency, better decision-making, and increased sales and revenue. By following the steps outlined in this article and addressing common challenges, insurance companies can successfully navigate the integration process and reap the rewards of a unified CRM–ERP ecosystem.

Conclusion

In conclusion, the strategic implementation of a Customer Relationship Management (CRM) system significantly streamlines and simplifies the integration process with Enterprise Resource Planning (ERP) systems for insurance companies. By centralizing customer data, automating workflows, and enhancing communication, CRM acts as a vital bridge, mitigating the complexities often associated with merging disparate systems. This improved integration leads to a more cohesive and efficient operational environment, fostering better decision-making, improved customer service, and ultimately, a stronger competitive advantage in the dynamic insurance landscape.

Reflecting on the benefits discussed, it’s clear that a CRM-driven approach to ERP integration is no longer a luxury, but a necessity for modern insurance providers. By leveraging the power of a well-integrated CRM and ERP system, companies can unlock unprecedented levels of efficiency and customer centricity. If your insurance company is struggling with fragmented data and disjointed processes, we encourage you to explore the possibilities of CRM and ERP integration. Contact us today for a consultation and discover how we can help you transform your operations and achieve your business goals.

Frequently Asked Questions (FAQ) about How CRM Makes ERP Integration Easier in Insurance Companies

Why integrate CRM and ERP in insurance?

Integrating CRM and ERP streamlines insurance operations by unifying customer data and financial processes. This improved data visibility helps insurers enhance customer service and optimize resource allocation, leading to greater efficiency.

How does CRM simplify ERP integration?

CRM acts as a central hub, consolidating customer interactions. This streamlined data flow simplifies ERP integration by providing a clear, structured dataset, reducing data silos and integration complexity in insurance companies.

What are the benefits of integrated CRM and ERP?

Integrated CRM and ERP in insurance boosts operational efficiency, improves customer satisfaction, and provides better financial insights. Insurers gain a 360-degree view of customer relationships and financial performance, enabling data-driven decisions.