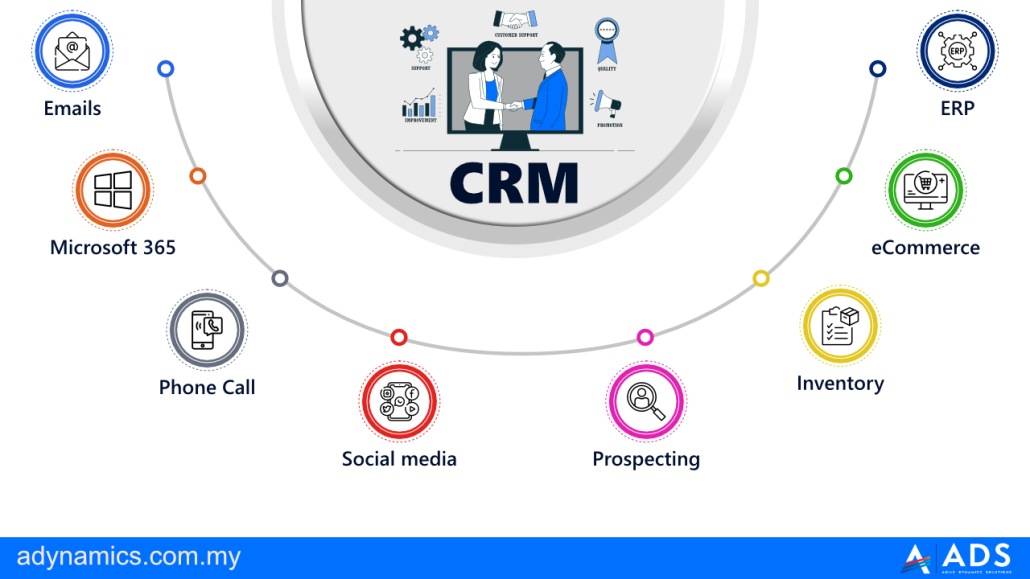

In the fast-paced world of insurance services, efficiency and customer satisfaction are paramount. Juggling policy management, claims processing, and customer communication can be a logistical nightmare without the right tools. That’s where the synergy between Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems comes into play. While CRM focuses on managing customer interactions and sales processes, ERP streamlines internal operations like finance, HR, and inventory management (though inventory is less relevant in the insurance context, the principle of resource management remains). When these two powerhouses are integrated effectively, insurance providers can unlock significant improvements in performance, leading to happier customers and a healthier bottom line.

Think of CRM as the front-end, the face of your insurance company, and ERP as the back-end, the engine that keeps everything running smoothly. Without a proper integration, you’re essentially running two separate businesses. Customer data might be siloed in the CRM, inaccessible to the ERP system, leading to inefficiencies in billing, claims processing, and reporting. Imagine a customer calling to inquire about a claim, and the agent having to manually search through multiple systems to find the relevant information. This not only frustrates the customer but also wastes valuable time and resources.

This article delves into the top ideas to leverage the powerful combination of CRM and ERP to drive exceptional performance in insurance services. We’ll explore key features, practical strategies, and detailed insights to help you optimize your operations, enhance customer experiences, and gain a competitive edge in the insurance industry. We’ll move beyond the theoretical and look at real-world examples of how integrated CRM and ERP systems are transforming insurance businesses, making them more agile, responsive, and profitable. We’ll explore key features, practical strategies, and Steps To CRM Automate ERP Functions For Insurance for better integration.

Understanding the Core Benefits of CRM–ERP Integration in Insurance

Integrating CRM and ERP systems offers a wealth of benefits specifically tailored to the needs of insurance providers. These benefits extend across various departments and processes, leading to significant improvements in overall efficiency and customer satisfaction.

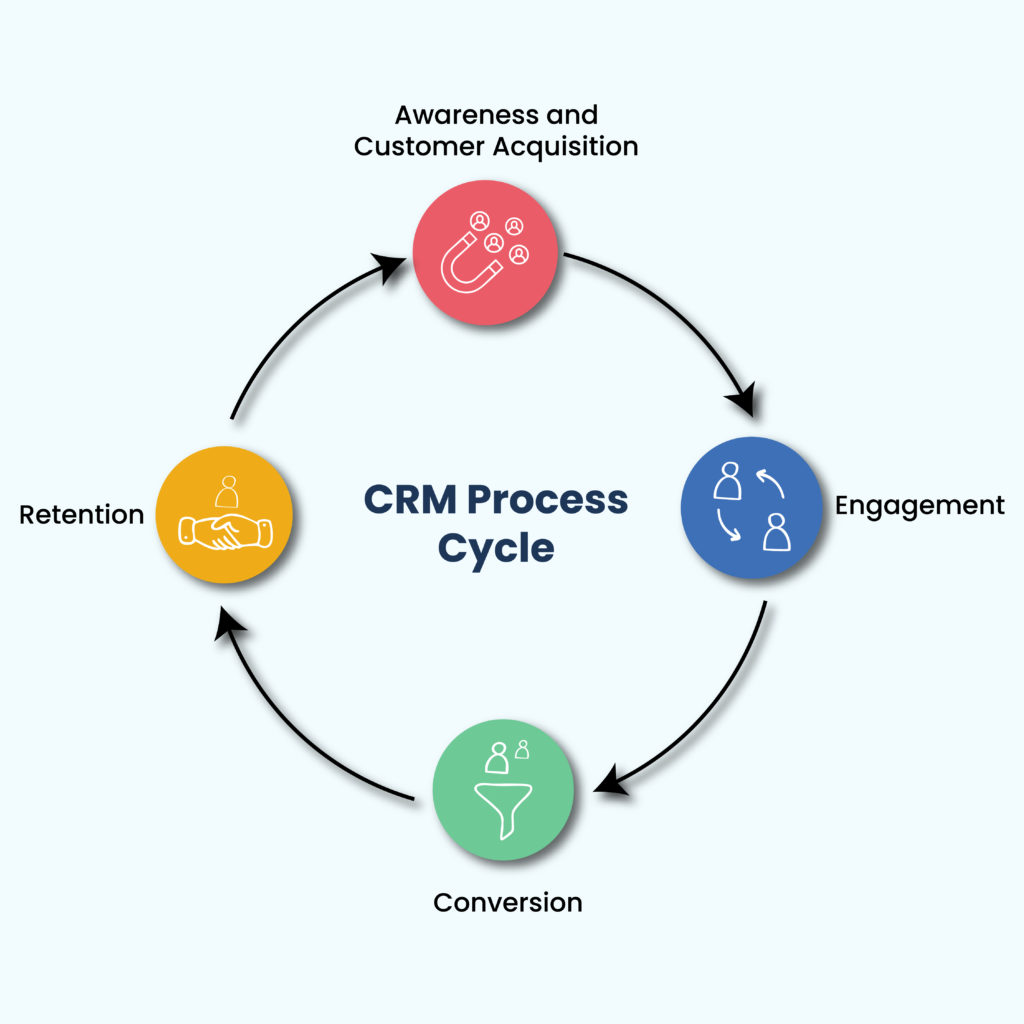

Enhanced Customer Experience

A unified view of the customer is perhaps the most significant benefit. By integrating CRM and ERP, insurance agents gain access to a comprehensive history of customer interactions, policies, claims, and billing information in a single interface. This enables them to provide personalized service, answer queries quickly and accurately, and resolve issues efficiently. Imagine an agent instantly knowing a customer’s entire history when they call, allowing them to proactively address potential concerns and offer tailored solutions.

Streamlined Claims Processing

Claims processing is a critical area where CRM–ERP integration can make a substantial difference. By connecting the CRM system, where claims are initially reported, with the ERP system, which manages the financial aspects of claims, the entire process becomes more streamlined. This integration can automate tasks such as claim validation, payment processing, and reporting, reducing manual errors and accelerating the payout process. Faster claims processing translates to happier customers and improved operational efficiency.

Improved Sales and Marketing Effectiveness

CRM provides valuable insights into customer behavior and preferences. When this data is integrated with ERP, insurance companies can gain a deeper understanding of their customer base and tailor their sales and marketing efforts accordingly. For example, by analyzing data on policy types, demographics, and claims history, insurance providers can identify potential cross-selling opportunities and develop targeted marketing campaigns. This leads to increased sales, improved customer retention, and a higher return on investment on marketing initiatives.

Optimized Financial Management

ERP systems excel at managing financial data, including premiums, claims payments, and commissions. Integrating ERP with CRM provides a comprehensive view of financial performance, enabling insurance companies to make more informed decisions about pricing, underwriting, and risk management. This integration also simplifies financial reporting and compliance, reducing the risk of errors and penalties.

Enhanced Data Accuracy and Consistency

Data silos are a common problem in many insurance organizations. When data is scattered across multiple systems, it can be difficult to maintain accuracy and consistency. CRM–ERP integration eliminates data silos by creating a single source of truth for customer and financial data. This ensures that everyone in the organization is working with the same information, reducing errors and improving decision-making.

Top Ideas to Drive ERP Performance with CRM in Insurance

Now that we understand the core benefits, let’s explore some specific ideas to maximize the performance of your ERP system by leveraging the power of CRM in the insurance context.

1. Automate Lead Management and Policy Quoting

Integrate CRM with your ERP‘s policy administration module to automate the lead management process. When a new lead is captured in the CRM, automatically create a corresponding record in the ERP system. This allows for seamless tracking of leads from initial contact to policy issuance. Furthermore, automate the policy quoting process by pulling data from the CRM into the ERP system to generate accurate and customized quotes. This reduces manual data entry, speeds up the quoting process, and improves the accuracy of quotes.

2. Streamline Claims Initiation and Adjudication

As mentioned earlier, claims processing is a critical area for improvement. Integrate your CRM system with the ERP‘s claims management module to streamline the entire process. When a customer reports a claim through the CRM, automatically create a claim record in the ERP system and initiate the adjudication process. Provide the customer with a claim number and track its progress through the CRM. This integration also allows for automated communication with the customer regarding the status of their claim.

3. Automate Commission Calculation and Payment

Calculating and paying commissions can be a time-consuming and error-prone process. Integrate your CRM system with the ERP‘s commission management module to automate this task. Use data from the CRM to automatically calculate commissions based on policy sales and renewals. Generate commission reports and process payments directly through the ERP system. This reduces manual effort, ensures accurate commission calculations, and improves agent satisfaction.

4. Implement a Customer Self-Service Portal

Empower your customers by providing them with a self-service portal that integrates with both your CRM and ERP systems. Allow customers to access their policy information, view claims status, make payments, and update their contact information through the portal. This reduces the burden on your customer service team and provides customers with greater control over their insurance policies.

5. Leverage Data Analytics for Predictive Modeling

Both CRM and ERP systems generate vast amounts of data. Integrate these data sources and leverage data analytics tools to identify trends, predict future outcomes, and make more informed decisions. For example, you can use data analytics to identify high-risk customers, predict claims frequency, and optimize pricing strategies. This enables you to proactively manage risk, improve profitability, and gain a competitive advantage.

6. Enhance Reporting and Compliance

Insurance companies are subject to strict regulatory requirements. Integrate your CRM and ERP systems to streamline reporting and compliance processes. Generate reports on key performance indicators (KPIs), such as sales, claims, and customer satisfaction. Automate the preparation of regulatory filings and ensure compliance with industry standards. This reduces the risk of errors and penalties and improves overall compliance.

7. Personalize Communication and Offerings

Use the integrated data from CRM and ERP to personalize communication and offerings to your customers. Segment your customer base based on demographics, policy types, and claims history. Tailor your marketing campaigns and customer service interactions to the specific needs and preferences of each segment. This leads to increased customer engagement, improved customer retention, and higher sales conversion rates.

Key Features to Look for in CRM and ERP Systems for Insurance

When selecting CRM and ERP systems for your insurance business, it’s crucial to consider features specifically designed for the industry. Here are some key features to look for:

CRM Features:

- Policy Management: Ability to track and manage all policy-related information.

- Claims Management: Functionality to log, track, and process claims efficiently.

- Lead Management: Tools to capture, qualify, and nurture leads.

- Customer Segmentation: Ability to segment customers based on various criteria.

- Marketing Automation: Features to automate marketing campaigns and personalize communication.

- Integration Capabilities: Seamless integration with ERP and other third-party systems.

ERP Features:

- Policy Administration: Management of policy issuance, renewals, and cancellations.

- Claims Processing: Automation of claims validation, payment processing, and reporting.

- Financial Management: Comprehensive financial reporting and analysis capabilities.

- Commission Management: Automated calculation and payment of commissions.

- Regulatory Compliance: Features to ensure compliance with industry regulations.

- Reporting and Analytics: Tools to generate reports and analyze data to identify trends and insights.

Common Challenges and How to Overcome Them

Implementing a CRM–ERP integration is not without its challenges. Here are some common hurdles and strategies to overcome them:

Data Migration:

Migrating data from legacy systems to the new integrated system can be complex and time-consuming. Ensure you have a well-defined data migration plan and allocate sufficient resources to this task. Consider using data migration tools to automate the process and minimize errors.

Integration Complexity:

Integrating CRM and ERP systems can be technically challenging, especially if they are from different vendors. Choose systems that offer pre-built integrations or work with an experienced integration partner to ensure a smooth and seamless integration process.

User Adoption:

Getting users to adopt the new integrated system can be challenging. Provide comprehensive training and support to users to help them understand the benefits of the new system and how to use it effectively. Involve users in the implementation process to gather feedback and address their concerns.

Change Management:

Implementing a CRM–ERP integration requires significant organizational change. Develop a change management plan to address the cultural and behavioral changes that are necessary for successful implementation. Communicate the benefits of the integration to all stakeholders and involve them in the process.

Conclusion

In conclusion, integrating CRM and ERP systems is a strategic imperative for insurance providers seeking to enhance operational efficiency, improve customer satisfaction, and gain a competitive edge. By automating key processes, streamlining data management, and leveraging data analytics, insurance companies can unlock significant improvements in performance. While challenges exist, a well-planned and executed integration can transform your business and drive long-term success. By focusing on the key ideas and features outlined in this guide, you can harness the power of CRM and ERP to create a truly customer-centric and efficient insurance organization.

Conclusion

In conclusion, the synergy between CRM and ERP systems holds immense potential for driving enhanced performance within insurance services. By strategically integrating these platforms, insurance providers can achieve a 360-degree view of their customers, streamline operations, and ultimately deliver superior service. The key takeaways from this exploration include leveraging CRM for personalized customer engagement, utilizing ERP for efficient policy and claims management, and employing data analytics to gain actionable insights. Embracing a unified approach allows for improved lead generation, optimized underwriting processes, and faster claims settlement, leading to increased profitability and customer satisfaction.

As the insurance landscape continues to evolve, embracing technological advancements is no longer a luxury, but a necessity for sustained success. We encourage insurance companies to seriously consider the transformative power of a well-integrated CRM and ERP system. Explore your options, analyze your specific needs, and take the necessary steps to unlock the full potential of your business. …seriously consider how to optimize their systems, including reviewing Best Tips To CRM Upgrade ERP Modules In. To learn more about implementing these strategies and achieving optimal integration, we invite you to contact us for a personalized consultation and discover how we can help you elevate your insurance operations to new heights.

Frequently Asked Questions (FAQ) about Top Ideas to CRM Drive ERP Performance in Insurance Services

How does CRM improve ERP in insurance?

CRM streamlines lead management and sales, feeding accurate data into the ERP. This improved data flow allows for better financial forecasting and resource allocation within the insurance ERP system.

Why integrate CRM and ERP for insurance?

Integration eliminates data silos, providing a 360-degree view of the customer. This holistic view enhances customer service, improves operational efficiency, and supports better decision-making within insurance operations.

What are CRM best practices for insurance ERP?

Prioritize data quality and consistent processes for both CRM and ERP. Automate workflows to reduce manual data entry and ensure accurate policy information is readily available across the integrated systems.