In the dynamic world of insurance, staying competitive requires more than just offering attractive policies. It demands a seamless, integrated approach to managing customer relationships, streamlining operations, and making data-driven decisions. This is where the synergy between Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems becomes crucial. While ERP handles the core operational aspects like policy administration, claims processing, and financial management, CRM focuses on nurturing customer interactions, managing sales pipelines, and providing personalized service. When these two powerful systems work in harmony, insurance companies can unlock significant efficiencies, improve customer satisfaction, and drive sustainable growth.

However, simply having both a CRM and an ERP system isn’t enough. The real magic happens when these systems are integrated effectively. A poorly integrated setup can lead to data silos, duplicated efforts, and a fragmented view of the customer. Imagine a situation where a customer updates their address in the CRM system, but this information doesn’t automatically update in the ERP system. This can lead to delayed policy documents, incorrect billing, and ultimately, a frustrated customer. Therefore, choosing the right CRM tools that can seamlessly integrate with your ERP is paramount for maximizing its capabilities and delivering a truly exceptional customer experience.

This comprehensive guide will delve into the world of CRM tools that are specifically designed to enhance ERP capabilities within insurance solutions. We’ll explore the key features to look for, the benefits of integration, and the factors to consider when selecting the right CRM for your organization. Whether you’re a small agency or a large multinational insurer, understanding how to leverage the power of CRM to complement your ERP can be a game-changer for your business. Additionally, consider Top Ideas To CRM Drive ERP Performance In for further insights. Let’s dive in and explore how to transform your insurance operations and elevate your customer relationships.

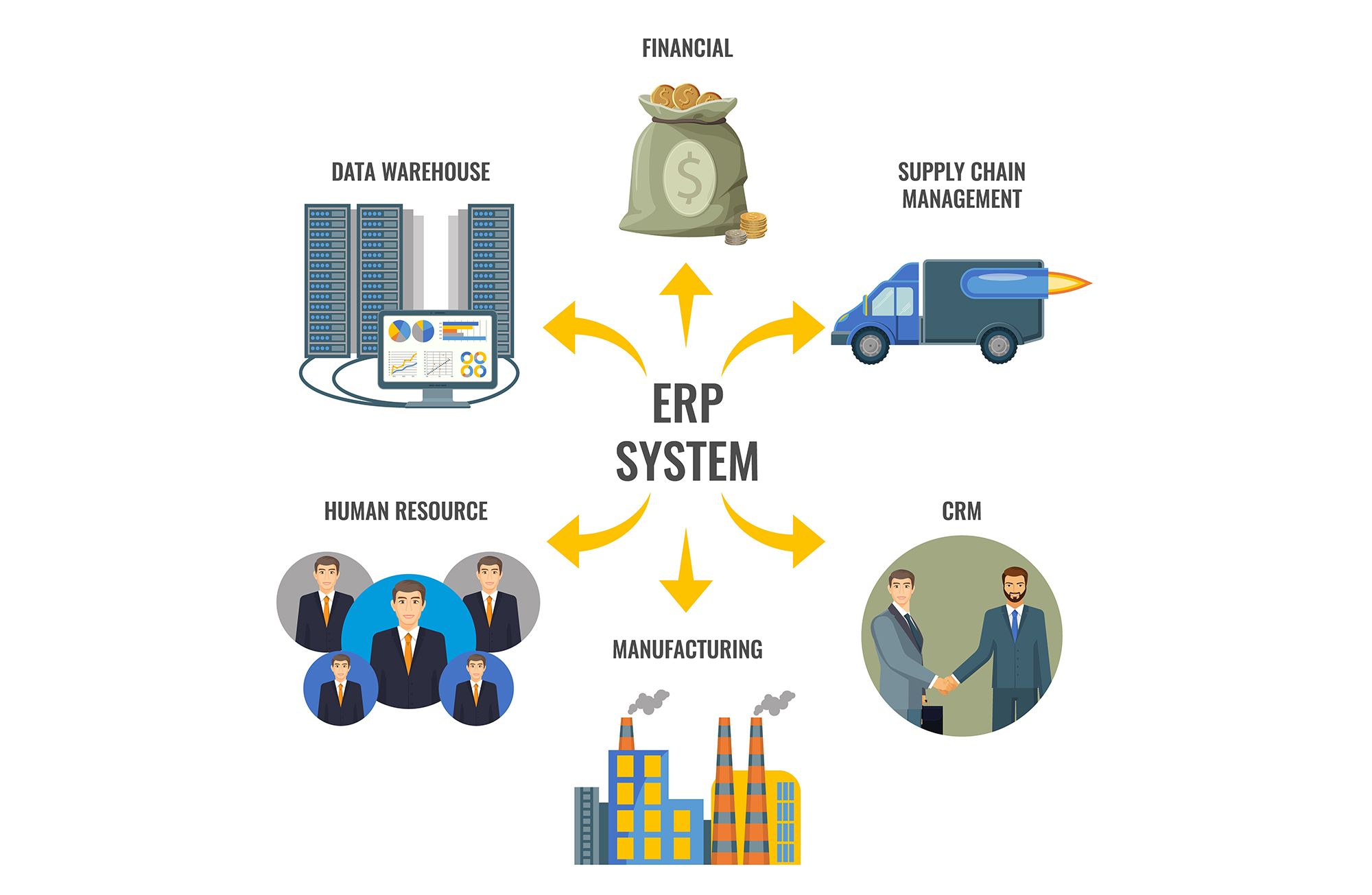

Understanding the Core Benefits of CRM–ERP Integration in Insurance

Integrating CRM and ERP systems in the insurance industry brings about a host of benefits that can significantly impact various aspects of the business. These benefits range from improved operational efficiency to enhanced customer experience and data-driven decision-making.

Enhanced Customer Experience

One of the most significant advantages of CRM–ERP integration is the ability to provide a more personalized and seamless customer experience. By integrating customer data from both systems, insurance companies can gain a 360-degree view of each customer, including their policy details, claims history, interactions with the company, and preferences. This comprehensive view allows agents and customer service representatives to provide tailored advice, resolve issues quickly, and build stronger relationships with customers. For example, when a customer calls with a question about their policy, the agent can instantly access all relevant information, including their policy details, claims history, and previous interactions, allowing them to provide a personalized and efficient response.

Improved Operational Efficiency

CRM–ERP integration streamlines various operational processes, eliminating manual data entry, reducing errors, and improving overall efficiency. For instance, when a new policy is created in the CRM system, the relevant data can be automatically transferred to the ERP system, eliminating the need for manual data entry and reducing the risk of errors. Similarly, when a customer submits a claim, the claim information can be automatically updated in both systems, allowing claims adjusters to access all the necessary information in one place. This streamlined process speeds up claims processing, reduces administrative costs, and improves the overall efficiency of the insurance company.

Data-Driven Decision-Making

By integrating CRM and ERP data, insurance companies can gain valuable insights into customer behavior, market trends, and operational performance. This data can be used to make informed decisions about product development, marketing campaigns, pricing strategies, and risk management. For example, by analyzing customer data from both systems, insurance companies can identify patterns in customer behavior and develop targeted marketing campaigns to attract new customers or retain existing ones. Similarly, by analyzing claims data, insurance companies can identify trends in claims frequency and severity, allowing them to adjust their pricing strategies and risk management practices accordingly.

Streamlined Sales and Marketing Processes

The integration of CRM and ERP enables more efficient sales and marketing efforts. Lead data captured in the CRM can be seamlessly transferred to the ERP for policy creation and management. Marketing campaigns can be tailored based on ERP data, such as policy types held or claims history, leading to more relevant and effective communications. This integration reduces the time and resources spent on manual data transfer and allows sales and marketing teams to focus on generating leads and closing deals.

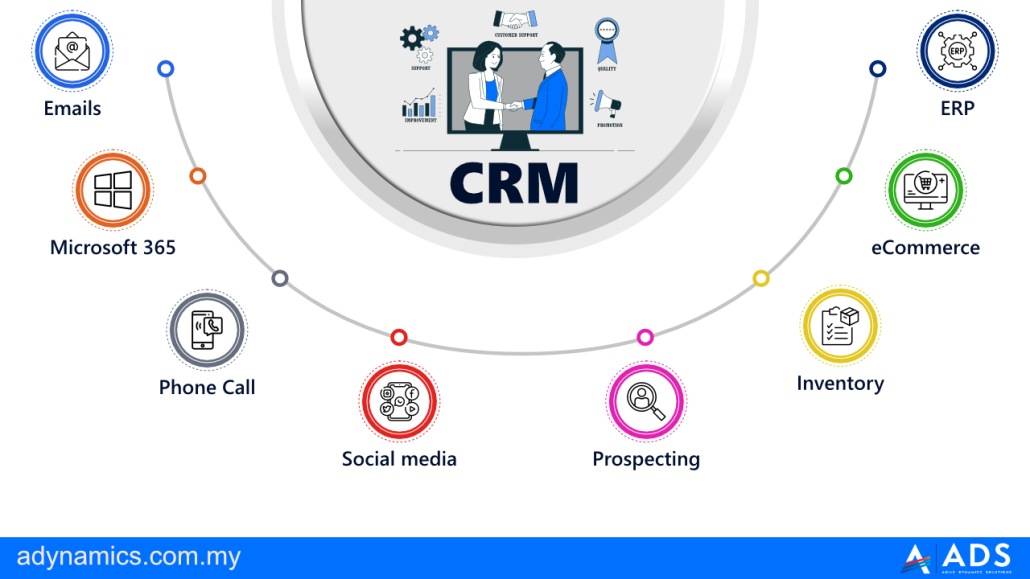

Key Features to Look for in CRM Tools for Insurance ERP Integration

When selecting a CRM tool to integrate with your insurance ERP system, several key features should be considered to ensure seamless integration and maximize the benefits of the combined system.

API Integrations and Connectivity

The CRM should offer robust API (Application Programming Interface) integrations and connectivity options to seamlessly connect with your existing ERP system. This allows for real-time data exchange between the two systems, ensuring that information is always up-to-date and accurate. Look for CRM systems that offer pre-built integrations with popular insurance ERP solutions or provide flexible APIs that can be customized to meet your specific integration needs.

Data Synchronization and Management

Effective data synchronization is crucial for maintaining data integrity and consistency across both systems. The CRM should offer features for automatically synchronizing data between the CRM and ERP, ensuring that customer information, policy details, and claims data are always in sync. Look for CRM systems that provide data mapping and transformation capabilities to ensure that data is accurately transferred between the two systems.

Workflow Automation

The CRM should offer workflow automation capabilities to streamline various insurance processes, such as lead management, policy creation, claims processing, and customer service. By automating these processes, insurance companies can reduce manual effort, improve efficiency, and ensure consistency. For example, a CRM can automatically trigger a policy creation workflow in the ERP system when a lead is converted into a customer. Similarly, a CRM can automatically update the customer’s policy details in the ERP system when a policy is renewed or modified.

Reporting and Analytics

The CRM should offer comprehensive reporting and analytics capabilities to provide insights into customer behavior, sales performance, and operational efficiency. The CRM should allow you to generate reports on various metrics, such as lead conversion rates, policy sales, claims processing times, and customer satisfaction. Look for CRM systems that offer customizable dashboards and reporting tools to track key performance indicators (KPIs) and identify areas for improvement. The ability to combine data from both CRM and ERP for comprehensive reporting is especially valuable.

Role-Based Access Control

The CRM should offer role-based access control to ensure that sensitive customer data is protected and only accessible to authorized personnel. This allows you to define different roles and permissions for users, ensuring that they only have access to the information they need to perform their jobs. For example, claims adjusters may have access to claims data, while sales representatives may have access to lead and policy information. This helps to maintain data security and compliance with industry regulations.

Popular CRM Tools for Insurance ERP Integration

Several CRM tools are well-suited for integration with insurance ERP systems. Here are a few popular options:

- Salesforce Financial Services Cloud: A leading CRM platform that offers specialized features for the financial services industry, including insurance. It provides robust integration capabilities, workflow automation, and reporting tools.

- Microsoft Dynamics 365 Sales: Another popular CRM platform that integrates seamlessly with Microsoft’s ERP solutions, such as Dynamics 365 Finance and Operations. It offers a wide range of features for sales management, marketing automation, and customer service.

- Zoho CRM: A cost-effective CRM solution that offers a wide range of features for small and medium-sized insurance agencies. It provides integrations with various ERP systems and offers workflow automation and reporting tools.

- Insightly: A CRM specifically designed for small businesses, Insightly offers project management features alongside core CRM functionality. Its ease of use and affordable pricing make it a good option for smaller insurance agencies.

Implementing CRM–ERP Integration: Best Practices

Implementing CRM–ERP integration can be a complex process, but following these best practices can help ensure a successful implementation:

Planning and Preparation

Thorough planning is essential for a successful CRM–ERP integration. This includes defining clear goals and objectives, identifying the key stakeholders, and developing a detailed implementation plan. It’s crucial to map out the data flow between the two systems and identify any potential data mapping or transformation requirements.

Data Migration and Cleansing

Migrating data from the existing systems to the integrated CRM–ERP platform can be a challenging task. It’s important to cleanse and validate the data before migrating it to the new system to ensure data accuracy and consistency. This may involve removing duplicate records, correcting errors, and standardizing data formats.

Testing and Training

Thorough testing is crucial to ensure that the integrated CRM–ERP system is functioning correctly and meeting the business requirements. This includes testing the data integration, workflow automation, and reporting capabilities. It’s also important to provide comprehensive training to users on how to use the new system effectively.

Ongoing Monitoring and Maintenance

CRM–ERP integration is not a one-time project. It requires ongoing monitoring and maintenance to ensure that the system continues to function correctly and meet the evolving business needs. This includes monitoring data synchronization, troubleshooting issues, and providing ongoing support to users.

Conclusion

CRM tools are essential for maximizing the capabilities of ERP systems in the insurance industry. By integrating these two powerful systems, insurance companies can improve customer experience, streamline operations, and make data-driven decisions. When selecting a CRM tool for insurance ERP integration, it’s important to consider key features such as API integrations, data synchronization, workflow automation, and reporting capabilities. By following best practices for implementation, insurance companies can ensure a successful CRM–ERP integration and unlock the full potential of their combined systems. The right CRM can transform your insurance operations, boost customer satisfaction, and drive sustainable growth in a competitive market.

Conclusion

In conclusion, the integration of robust CRM tools with existing ERP systems offers insurance companies a significant competitive advantage. By streamlining operations, enhancing customer engagement, and providing a unified view of client data, these integrated solutions empower insurers to make more informed decisions and deliver personalized services. The ability to automate workflows, track interactions, and analyze customer behavior ultimately leads to improved efficiency, increased sales, and stronger customer loyalty – all vital components for success in today’s dynamic insurance landscape.

Reflecting on the capabilities discussed, it’s clear that leveraging the synergy between CRM and ERP systems is no longer a luxury, but a necessity for insurance businesses seeking sustainable growth and optimal performance. To unlock the full potential of your organization and ensure you’re providing the best possible experience for your clients, we encourage you to explore the CRM solutions discussed and consider how they can seamlessly integrate with your existing ERP infrastructure. Take the next step towards transforming your insurance operations today. Indeed, understanding How To CRM Adapt ERP Features For Insurance is key to that synergy. Learn more about specific CRM integrations and success stories on our website:

Frequently Asked Questions (FAQ) about CRM Tools That Maximize ERP Capabilities in Insurance Solutions

What are the benefits of integrating CRM and ERP in insurance?

Integrating CRM and ERP streamlines insurance processes. It provides a unified view of customer data, improving sales, service, and operational efficiency. This leads to better decision-making and enhanced customer satisfaction.

How does CRM enhance ERP for insurance sales?

CRM provides detailed customer insights to ERP. This allows for targeted marketing campaigns and personalized policy recommendations. Consequently, insurance sales teams can close deals faster and more effectively.

Which CRM features are key for insurance ERP integration?

Key CRM features include lead management, policy tracking, and automated workflows. When integrated with ERP, these features improve data accuracy and operational efficiency. This optimizes resource allocation and reduces manual errors.