The insurance industry, traditionally known for its reliance on legacy systems, is undergoing a rapid transformation. To stay competitive and meet evolving customer expectations, insurers are increasingly looking towards innovative solutions. Integrating Customer Relationship Management (CRM) systems with Enterprise Resource Planning (ERP) features presents a powerful way to drive innovation, streamline operations, and enhance customer experiences. This convergence allows insurers to leverage the strengths of both systems, creating a unified platform that supports everything from policy management and claims processing to financial accounting and regulatory compliance.

However, simply implementing a CRM and ERP system isn’t enough. The key lies in strategically adapting ERP features within the CRM environment to address the specific challenges and opportunities within the insurance sector. This involves understanding the core functionalities of each system and identifying how they can be combined to create new efficiencies and capabilities. From automating workflows and personalizing customer interactions to improving data accuracy and gaining deeper insights into business performance, the possibilities are vast.

This article provides a comprehensive guide on how to effectively adapt ERP features for insurance innovations within a CRM system. We’ll explore the specific ERP functionalities that are most relevant to the insurance industry, discuss how they can be integrated with CRM, and provide practical examples of how these integrations can drive tangible business benefits. We’ll also delve into the challenges associated with this integration process and offer strategies for overcoming them, ensuring a successful implementation that delivers real value for your organization. We’ll explore the relevant ERP functionalities, building upon CRM Insights To Enhance ERP Value In Insurance.

Understanding the Core Synergies: CRM and ERP in Insurance

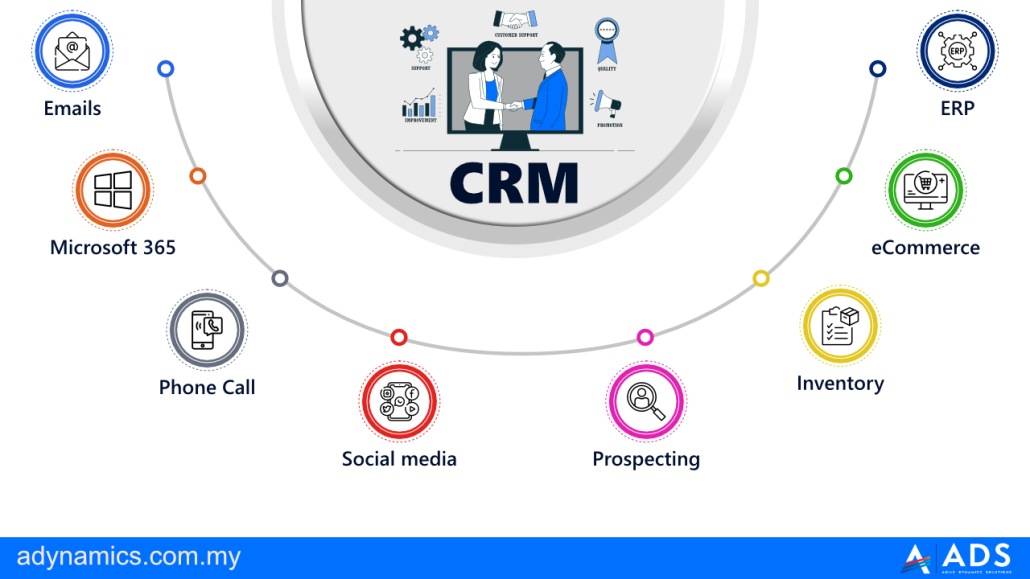

Traditionally, CRM systems focused on managing customer interactions, sales, and marketing, while ERP systems handled back-office operations such as finance, human resources, and supply chain management. In the insurance industry, however, the lines between these functions are blurring. Customers expect seamless interactions across all touchpoints, and insurers need a unified view of their operations to make informed decisions.

Key CRM Features for Insurance

CRM systems provide a centralized platform for managing customer data, interactions, and relationships. Key features include:

- Contact Management: Storing and organizing customer information, including contact details, policy information, and interaction history.

- Sales Automation: Automating sales processes, such as lead generation, opportunity management, and quote creation.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media marketing, and event management.

- Customer Service: Providing tools for managing customer inquiries, complaints, and support requests.

- Analytics and Reporting: Providing insights into customer behavior, sales performance, and marketing effectiveness.

Key ERP Features Relevant to Insurance

ERP systems provide a comprehensive suite of tools for managing back-office operations. Key features relevant to the insurance industry include:

- Financial Management: Managing financial accounting, budgeting, and reporting.

- Policy Management: Managing policy issuance, renewals, and cancellations.

- Claims Management: Managing claims processing, from initial claim filing to final settlement.

- Regulatory Compliance: Ensuring compliance with industry regulations and reporting requirements.

- Data Management: Managing and integrating data from various sources, ensuring data accuracy and consistency.

Adapting ERP Features Within CRM for Insurance Innovation

The real power of CRM and ERP integration lies in adapting specific ERP features within the CRM environment to enhance customer interactions and streamline processes. Here are some examples:

Integrating Policy Management for Personalized Customer Service

By integrating policy management data from the ERP system into the CRM, customer service representatives can access real-time policy information directly within the CRM interface. This allows them to quickly answer customer inquiries, resolve issues, and provide personalized service. For example, a customer calling to inquire about their policy coverage can be immediately provided with the relevant information, eliminating the need to switch between systems or put the customer on hold.

Streamlining Claims Processing with CRM-Integrated ERP

The claims process can be significantly improved by integrating claims management data from the ERP system into the CRM. This allows claims adjusters to access customer information, policy details, and claims history from a single location. Furthermore, the CRM can be used to automate communication with customers throughout the claims process, providing updates on the status of their claim and requesting necessary information. This can reduce processing times, improve customer satisfaction, and minimize the risk of errors.

Enhancing Sales and Marketing with Financial Data

Integrating financial data from the ERP system into the CRM can provide valuable insights for sales and marketing teams. For example, data on policy profitability can be used to identify high-value customers and tailor marketing campaigns accordingly. Sales teams can also use financial data to identify cross-selling and upselling opportunities, offering customers additional products and services that meet their needs.

Improving Regulatory Compliance with Integrated Data

The insurance industry is heavily regulated, and compliance is critical. Integrating data from the ERP and CRM systems can help insurers meet their regulatory obligations by providing a comprehensive view of their operations. This allows them to generate accurate reports, track compliance metrics, and identify potential risks. For example, data on policy sales, claims processing, and financial transactions can be used to demonstrate compliance with anti-money laundering regulations.

Practical Examples of CRM-Adapted ERP Features in Action

Let’s look at some specific scenarios where adapting ERP features within a CRM system can drive innovation in the insurance industry:

Scenario 1: Proactive Policy Renewal Reminders

Problem: Customers often forget to renew their policies, leading to lapses in coverage and lost revenue for the insurer.

Solution: Integrate policy renewal dates from the ERP system into the CRM. Use the CRM‘s marketing automation capabilities to send proactive renewal reminders to customers via email or SMS. Personalize the reminders with policy details and offer incentives for early renewal. This aligns with Best Tips To CRM Upgrade ERP Modules In, offering further guidance.

Benefit: Increased policy renewal rates, reduced customer churn, and improved customer satisfaction.

Scenario 2: Automated Claims Status Updates

Problem: Customers often experience anxiety and frustration during the claims process due to a lack of communication.

Solution: Integrate claims status updates from the ERP system into the CRM. Use the CRM‘s customer service module to automatically send email or SMS notifications to customers whenever their claim status changes. Provide clear and concise information about the next steps in the process. This is similar to what’s discussed in How To CRM Align ERP Implementation For Insurance.

Benefit: Reduced customer inquiries, improved customer satisfaction, and increased efficiency for claims adjusters.

Scenario 3: Personalized Product Recommendations

Problem: Insurers struggle to identify and offer customers the right products and services at the right time.

Solution: Integrate customer data from the CRM with policy data and financial data from the ERP system. Use data analytics to identify patterns and predict customer needs. Provide personalized product recommendations to sales agents through the CRM interface, empowering them to offer tailored solutions. To that end, integrate Customer relationship management data with ERP system information.

Benefit: Increased sales, improved customer loyalty, and enhanced customer lifetime value.

Challenges and Considerations for Implementation

While the benefits of adapting ERP features within a CRM system are significant, the implementation process can be complex. Here are some common challenges and considerations:

Data Integration Challenges

Integrating data from different systems can be challenging due to differences in data formats, structures, and definitions. It’s crucial to develop a comprehensive data integration strategy that addresses these challenges and ensures data accuracy and consistency. This often involves data cleansing, data transformation, and data mapping.

System Compatibility Issues

CRM and ERP systems may not be inherently compatible, requiring custom integrations or middleware solutions. It’s important to carefully evaluate the compatibility of different systems and choose solutions that are designed to work together seamlessly.

Change Management and User Adoption

Implementing a new system or integrating existing systems can require significant changes to business processes and workflows. It’s crucial to develop a comprehensive change management plan that addresses employee concerns, provides training, and ensures user adoption.

Security and Compliance

Data security and compliance are paramount in the insurance industry. It’s important to implement robust security measures to protect sensitive customer data and ensure compliance with industry regulations. This includes data encryption, access controls, and regular security audits.

Choosing the Right CRM and ERP Solutions

Selecting the right CRM and ERP solutions is critical for a successful integration. Here are some factors to consider:

Industry-Specific Functionality

Choose solutions that are specifically designed for the insurance industry and offer the features and functionalities you need to meet your unique business requirements.

Integration Capabilities

Select solutions that offer robust integration capabilities and support seamless data exchange between systems.

Scalability and Flexibility

Choose solutions that can scale to meet your growing business needs and adapt to changing market conditions.

Vendor Support and Training

Select vendors that offer comprehensive support and training to ensure a smooth implementation and ongoing maintenance.

Conclusion: Embracing Innovation Through Integrated Systems

Adapting ERP features within a CRM system offers a powerful way for insurance companies to drive innovation, streamline operations, and enhance customer experiences. By integrating these systems, insurers can gain a unified view of their business, automate workflows, personalize customer interactions, and improve regulatory compliance. While the implementation process can be challenging, the benefits are significant. By carefully planning the integration, addressing potential challenges, and choosing the right solutions, insurers can unlock the full potential of CRM and ERP and achieve a competitive advantage in today’s rapidly evolving market.

Conclusion

In conclusion, the integration of CRM and ERP functionalities within the insurance sector represents a powerful catalyst for innovation. By strategically adapting key ERP features such as financial management, supply chain oversight, and robust reporting capabilities, insurers can equip their CRM systems with enhanced data insights and operational efficiency. This, in turn, fosters a deeper understanding of customer needs, allows for personalized product offerings, and ultimately drives a more competitive edge in an increasingly dynamic market. The journey of converging these two vital systems requires careful planning and execution, but the potential rewards for enhanced customer relationships and streamlined business processes are substantial.

As we have explored, the successful adaptation of ERP features into a CRM framework unlocks significant opportunities for insurance companies to not only improve their internal operations but also to deliver exceptional customer experiences. The ability to leverage integrated data for targeted marketing, proactive service, and efficient claims processing is paramount in today’s digital landscape. Now is the time for insurance leaders to re-evaluate their technology strategies and explore how a tailored CRM–ERP integration can fuel their next wave of innovation. To learn more about how this can benefit your organization, we encourage you to contact our team of experts for a personalized consultation.

Frequently Asked Questions (FAQ) about How to CRM Adapt ERP Features for Insurance Innovations

Can ERP data improve insurance CRM?

Yes, integrating ERP data like financial and operational details into a CRM provides a 360-degree customer view. This enables personalized service and targeted insurance product offerings, improving customer satisfaction and sales.

How does CRM enhance insurance ERP features?

CRM enhances insurance ERP by adding customer-centric functionalities like lead management and marketing automation. This helps leverage ERP data for better customer engagement, driving policy sales and renewals effectively.

What are the benefits of CRM-ERP integration for insurance?

CRM-ERP integration for insurance streamlines processes, reduces operational costs, and improves data accuracy. It allows for better risk assessment and personalized policy pricing, ultimately leading to increased profitability and customer retention.