The insurance industry is undergoing a massive digital transformation. To stay competitive, insurers are leveraging technology to improve customer experiences, streamline operations, and gain a deeper understanding of risk. Two crucial technologies driving this transformation are Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems. While CRM focuses on managing customer interactions and sales processes, ERP integrates core business processes, including finance, HR, and operations. However, implementing and maintaining these systems can be expensive, and balancing the costs of CRM and ERP within the context of insurance digitalization is a significant challenge.

The complexity of insurance products, the stringent regulatory environment, and the need for personalized customer service all contribute to the high costs associated with digital transformation. Integrating CRM and ERP systems is particularly challenging because it requires aligning customer-facing processes with back-end operations. A disconnect between these systems can lead to inefficiencies, data silos, and a poor customer experience. Therefore, a strategic approach to CRM and ERP implementation is essential for maximizing the benefits of digitalization while controlling costs.

This comprehensive guide explores how insurance companies can effectively balance CRM and ERP costs within their digitalization strategies. We’ll delve into the key features of both systems, discuss the challenges of integration, and provide practical tips for optimizing costs. By understanding the nuances of CRM and ERP implementation in the insurance industry, companies can make informed decisions that drive efficiency, improve customer satisfaction, and achieve a strong return on investment. We’ll delve into the key features of both systems, considering How CRM Optimizes ERP Adoption For Insurance Professionals along the way. This guide will equip you with the knowledge and strategies needed to navigate the complexities of insurance digitalization and achieve a harmonious balance between CRM and ERP investments.

Understanding CRM and ERP in Insurance Digitalization

CRM and ERP systems are fundamental to digital transformation in the insurance industry. Each plays a distinct role, and their integration is crucial for creating a seamless and efficient operation.

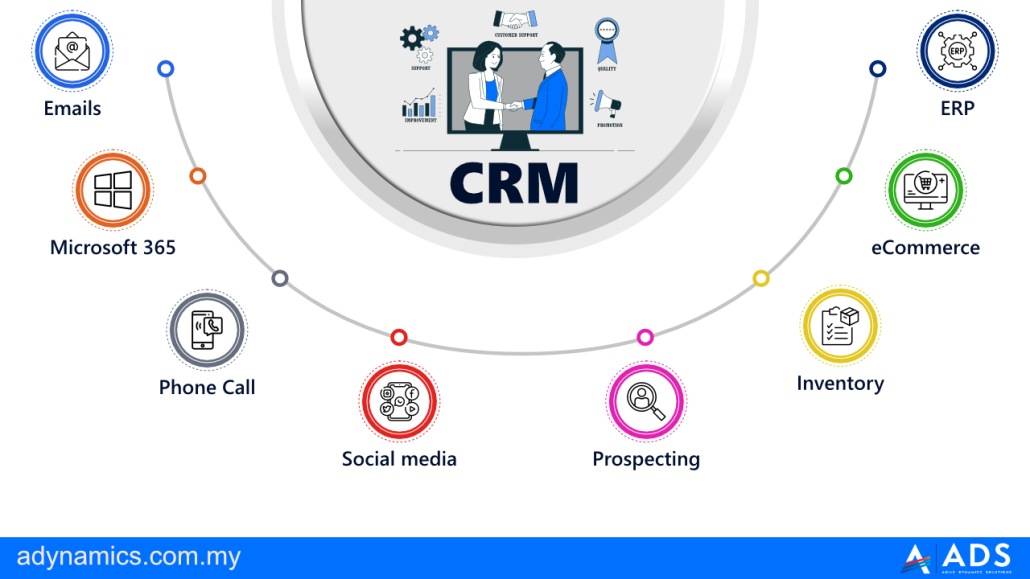

CRM: The Customer-Centric Approach

CRM systems are designed to manage and analyze customer interactions and data throughout the customer lifecycle. In insurance, this includes managing leads, tracking policies, handling claims, and providing customer support. Key features of a CRM system for insurance include:

- Lead Management: Capturing and nurturing leads to convert them into customers.

- Policy Management: Tracking policy details, renewals, and cancellations.

- Claims Management: Streamlining the claims process from initial reporting to settlement. These processes are key components of Customer relationship management, ensuring efficient operations.

- Customer Service: Providing personalized support through various channels (phone, email, chat).

- Analytics and Reporting: Gaining insights into customer behavior and trends to improve decision-making.

A well-implemented CRM system allows insurers to personalize customer interactions, improve customer satisfaction, and increase sales.

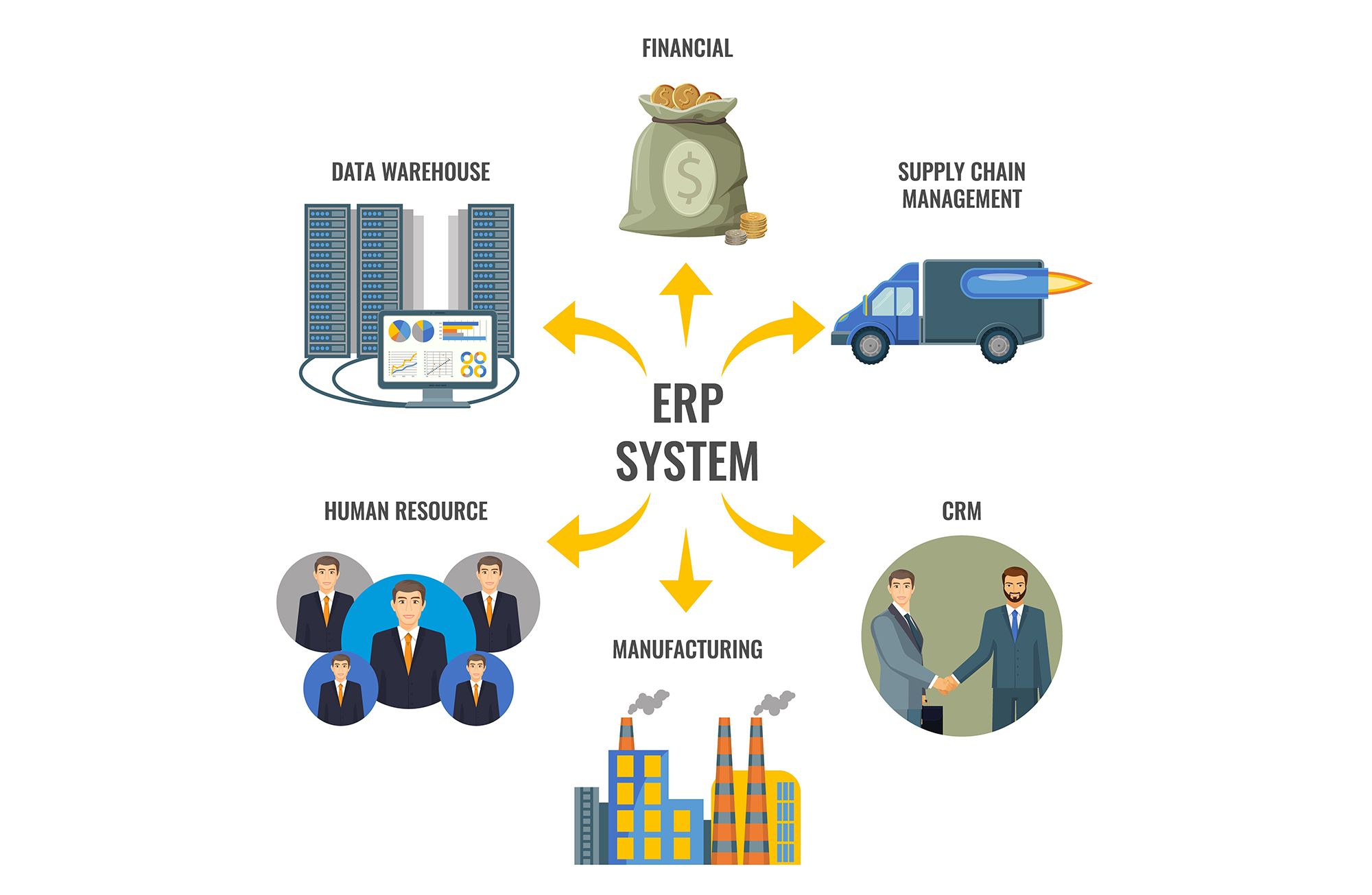

ERP: The Backbone of Operations

ERP systems integrate core business processes, such as finance, human resources, supply chain management, and operations. In insurance, ERP systems are used to manage financial transactions, track employee information, and handle regulatory compliance. Key features of an ERP system for insurance include:

- Financial Management: Managing accounting, budgeting, and financial reporting.

- Human Resources: Managing employee data, payroll, and benefits.

- Compliance Management: Ensuring adherence to regulatory requirements. Compliance management, alongside How To CRM Adapt ERP Features For Insurance, ensures regulatory requirements.

- Data Management: Centralizing and managing data across the organization.

- Reporting and Analytics: Providing insights into operational performance.

An effective ERP system streamlines operations, improves efficiency, and provides a single source of truth for business data.

The Synergistic Relationship: CRM and ERP Integration

The real power of CRM and ERP lies in their integration. When these systems are connected, insurers can gain a holistic view of their business, from customer interactions to financial performance. For example, a claim processed through the CRM system can automatically trigger financial transactions in the ERP system. This integration eliminates data silos, reduces manual data entry, and improves decision-making.

Challenges of CRM and ERP Implementation in Insurance

Implementing CRM and ERP systems in the insurance industry is not without its challenges. These challenges can significantly impact the costs and success of digitalization initiatives.

Data Migration and Integration

Migrating data from legacy systems to new CRM and ERP systems can be a complex and time-consuming process. Data must be cleaned, transformed, and validated to ensure accuracy and consistency. Integrating CRM and ERP systems requires careful planning and execution to avoid data silos and ensure seamless data flow.

Customization and Configuration

Insurance companies often require significant customization of CRM and ERP systems to meet their specific business needs. This customization can be expensive and time-consuming, and it can also increase the risk of errors and integration issues. Finding the right balance between customization and out-of-the-box functionality is crucial for controlling costs and ensuring a successful implementation.

User Adoption and Training

A successful CRM and ERP implementation depends on user adoption. Employees must be trained on how to use the new systems effectively. Resistance to change can be a significant obstacle, and it’s important to address employee concerns and provide ongoing support.

Security and Compliance

Insurance companies handle sensitive customer data, and they must comply with strict regulatory requirements. CRM and ERP systems must be secured to protect against data breaches and ensure compliance with regulations such as GDPR and HIPAA.

Cost Overruns and Budget Management

CRM and ERP implementations are often prone to cost overruns. Scope creep, unexpected technical challenges, and inadequate planning can all contribute to increased costs. Effective budget management and project planning are essential for staying within budget.

Strategies for Balancing CRM and ERP Costs

Balancing CRM and ERP costs requires a strategic approach that considers the specific needs of the insurance company and the potential benefits of digitalization.

Start with a Clear Business Strategy

Before embarking on a CRM and ERP implementation, it’s crucial to define a clear business strategy and identify the specific goals you want to achieve. This strategy should guide your technology decisions and ensure that your investments are aligned with your business objectives. Ask yourself: What problems are we trying to solve? What are our key performance indicators (KPIs)? How will CRM and ERP help us achieve our goals?

Choose the Right Software

Selecting the right CRM and ERP software is critical for controlling costs and ensuring a successful implementation. Consider factors such as the size of your organization, the complexity of your business processes, and your budget. Cloud-based solutions can often be more cost-effective than on-premise solutions, but they may not be suitable for all organizations. Look for vendors with experience in the insurance industry and a proven track record of successful implementations.

Phased Implementation

A phased implementation approach can help to reduce risk and control costs. Instead of implementing all modules at once, start with the most critical processes and gradually roll out additional functionality. This allows you to learn from your experiences and make adjustments as needed.

Prioritize Integration

Integration between CRM and ERP systems is essential for realizing the full benefits of digitalization. Prioritize integration efforts and ensure that data flows seamlessly between the two systems. Use integration tools and APIs to simplify the integration process.

Invest in Training and Change Management

User adoption is crucial for a successful CRM and ERP implementation. Invest in training and change management to ensure that employees understand the benefits of the new systems and are comfortable using them. Provide ongoing support and address employee concerns promptly.

Monitor and Optimize

Once your CRM and ERP systems are implemented, it’s important to monitor their performance and optimize them over time. Track key metrics such as customer satisfaction, sales growth, and operational efficiency. Identify areas for improvement and make adjustments as needed.

Consider Outsourcing

For some insurance companies, outsourcing CRM and ERP implementation and maintenance can be a cost-effective option. Outsourcing can provide access to specialized expertise and reduce the burden on internal IT resources.

Key Features to Look for in Insurance-Specific CRM and ERP Systems

When evaluating CRM and ERP systems for insurance, consider the following key features:

Industry-Specific Functionality

Look for systems that are specifically designed for the insurance industry and offer features such as policy management, claims management, and regulatory compliance.

Integration Capabilities

Ensure that the CRM and ERP systems can be easily integrated with each other and with other business systems.

Scalability

Choose systems that can scale to meet your growing business needs.

Security Features

Prioritize systems with robust security features to protect sensitive customer data.

Reporting and Analytics

Look for systems that offer comprehensive reporting and analytics capabilities to provide insights into business performance.

Conclusion: Embracing Digitalization with a Balanced Approach

Digitalization is essential for insurance companies to remain competitive in today’s rapidly changing market. By carefully balancing CRM and ERP costs and implementing a strategic approach, insurers can achieve significant benefits, including improved customer satisfaction, increased sales, and enhanced operational efficiency. The key is to start with a clear business strategy, choose the right software, prioritize integration, invest in training, and continuously monitor and optimize your systems. By embracing digitalization with a balanced approach, insurance companies can unlock new opportunities for growth and success.

Conclusion

Successfully navigating the digital transformation in the insurance industry demands a strategic approach to technology investment. As this article has explored, finding the right balance between CRM and ERP costs is crucial for maximizing efficiency, enhancing customer experience, and ultimately, driving profitability. Simply implementing these systems is not enough; a thorough understanding of their individual strengths, integration potential, and impact on existing workflows is paramount. Ignoring this delicate equilibrium can lead to overspending, underperformance, and a failure to realize the full benefits of digitalization.

Ultimately, the key to CRM and ERP cost optimization lies in meticulous planning, data-driven decision-making, and a commitment to continuous improvement. By carefully assessing your specific business needs, choosing solutions that integrate seamlessly, and proactively monitoring performance metrics, insurance companies can achieve a significant return on investment. The future of insurance is undoubtedly digital, and those who master the art of balancing CRM and ERP costs will be best positioned to thrive. Ultimately, the key to CRM and ERP cost optimization lies in meticulous planning, data-driven decision-making, and a commitment to continuous improvement. By carefully assessing your specific business, including how to Steps To CRM Automate ERP Functions For Insurance, Are you ready to unlock the full potential of your digital transformation? Contact us today for a consultation and discover how we can help you optimize your technology investments and achieve lasting success: Learn More.

Frequently Asked Questions (FAQ) about How to CRM Balance ERP Costs in Insurance Digitalization

How can CRM reduce ERP costs in insurance?

CRM improves customer data quality, reducing errors in ERP systems. Better data leads to streamlined processes and fewer costly manual interventions in areas like policy administration and claims processing, saving money.

What’s the ROI of integrating CRM with ERP?

Integrated CRM and ERP in insurance boosts efficiency and sales. ROI comes from reduced operational costs, improved customer retention, and increased revenue through targeted marketing campaigns, often exceeding initial investment.

Which CRM features help optimize ERP spending?

CRM features like sales forecasting, lead management, and automated workflows significantly impact ERP spend. Accurate forecasting minimizes inventory costs and resource allocation, while streamlined processes reduce manual tasks within the ERP.