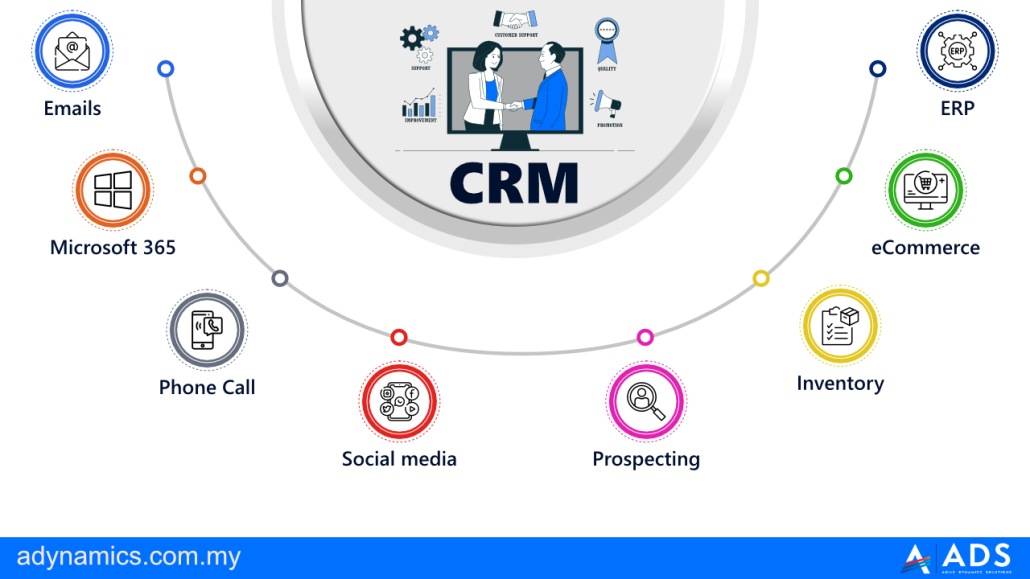

The insurance industry, a landscape defined by intricate regulations, demanding customer expectations, and the constant pressure to optimize operational efficiency, often finds itself at a crossroads when it comes to technology adoption. Enterprise Resource Planning (ERP) systems, designed to streamline business processes and centralize data, hold immense promise for insurance professionals. However, the complexity and scope of ERP implementations can be daunting, leading to resistance and ultimately, failed adoption. This is where Customer Relationship Management (CRM) systems play a pivotal role, acting as a bridge to facilitate smoother and more successful ERP integration.

Think of CRM as the front door of your insurance agency, the system your agents and brokers interact with daily to manage client relationships, track leads, and close deals. ERP, on the other hand, is the engine room, handling the back-end processes like policy administration, claims processing, and financial accounting. When these two systems are aligned, the benefits are exponential. CRM provides the user-friendly interface and readily available customer data that can alleviate the learning curve associated with ERP, making the transition less disruptive and more palatable for insurance professionals.

This article will delve into the critical role CRM plays in optimizing ERP adoption for insurance professionals. We’ll explore how CRM features specifically address the challenges of ERP implementation, focusing on data migration, user training, workflow integration, and overall change management. We’ll also examine the specific benefits insurance agencies can reap from a well-integrated CRM–ERP system, ultimately demonstrating how this powerful combination can drive growth, improve customer satisfaction, and enhance operational efficiency in the competitive insurance market. This article will delve into the critical role CRM plays in optimizing ERP adoption for insurance professionals. We’ll explore how CRM features specifically address the challenges of ERP implementation, drawing from Best Tips To CRM Upgrade ERP Modules In.

Understanding the Challenges of ERP Adoption in Insurance

ERP systems, while powerful, are notoriously complex to implement. In the insurance industry, this complexity is amplified by the specific needs and regulations governing the sector. Understanding these challenges is the first step towards successful adoption.

Data Migration and Cleansing

One of the biggest hurdles is data migration. Insurance agencies often have vast amounts of data stored in disparate systems, from legacy databases to spreadsheets. Migrating this data to the new ERP system requires careful planning, cleansing, and validation. Inaccurate or incomplete data can lead to significant errors and inefficiencies in the ERP system, undermining its value. CRM can help by providing a centralized repository for customer data, allowing for easier cleansing and validation before it’s migrated to the ERP system. By ensuring data accuracy from the outset, the ERP implementation process becomes significantly smoother.

User Training and Change Management

ERP implementation requires significant changes in how insurance professionals work. This can lead to resistance, especially if users are unfamiliar with the new system or feel that it will make their jobs more difficult. Effective training and change management are crucial for overcoming this resistance. CRM can play a vital role here by providing a familiar interface for users. Since many insurance professionals already use CRM systems for their daily tasks, integrating CRM with ERP allows them to access ERP functionalities through a familiar platform. This reduces the learning curve and makes the transition less disruptive.

Workflow Integration and Process Optimization

ERP systems are designed to streamline business processes. However, if these processes are not properly integrated with existing workflows, the ERP implementation can actually decrease efficiency. Insurance agencies need to carefully map their existing workflows and identify opportunities for optimization. CRM can help by providing a clear view of customer interactions and sales processes. This information can be used to design more efficient workflows that integrate seamlessly with the ERP system. For example, a new policy created in CRM can automatically trigger the creation of corresponding records in the ERP system, eliminating manual data entry and reducing the risk of errors.

Regulatory Compliance and Security

The insurance industry is heavily regulated, and ERP systems must comply with these regulations. This can add another layer of complexity to the implementation process. Insurance agencies need to ensure that their ERP system is secure and that it complies with all relevant regulations, such as HIPAA and GDPR. CRM can help by providing security features and compliance tools that integrate with the ERP system. This ensures that sensitive customer data is protected and that the agency is compliant with all relevant regulations.

How CRM Optimizes ERP Adoption

CRM’s role in optimizing ERP adoption goes beyond simply providing a familiar interface. It offers a range of features and functionalities that directly address the challenges outlined above.

Centralized Customer Data

As mentioned earlier, CRM acts as a central repository for customer data. This allows insurance agencies to cleanse and validate data before it’s migrated to the ERP system. CRM systems typically include data quality tools that can identify and correct errors, such as duplicate records and incomplete information. By ensuring data accuracy from the outset, the ERP implementation process becomes significantly smoother and the resulting system more reliable.

User-Friendly Interface

CRM systems are designed to be user-friendly, with intuitive interfaces that are easy to learn and use. By integrating CRM with ERP, insurance agencies can provide their employees with a familiar platform for accessing ERP functionalities. This reduces the learning curve and makes the transition to the new system less disruptive. Agents can continue to use the CRM system they’re familiar with while also benefiting from the enhanced capabilities of the ERP system.

Workflow Automation

CRM systems can automate many of the tasks that insurance professionals perform on a daily basis. This can free up time for them to focus on more important tasks, such as building relationships with customers and closing deals. By integrating CRM with ERP, insurance agencies can automate even more tasks, such as policy administration and claims processing. For example, when a customer submits a claim through the CRM system, the claim can be automatically routed to the appropriate department in the ERP system for processing. This reduces manual data entry and speeds up the claims process.

Reporting and Analytics

CRM systems provide powerful reporting and analytics capabilities that can help insurance agencies track their performance and identify areas for improvement. By integrating CRM with ERP, insurance agencies can gain even more insights into their business. For example, they can track the profitability of different types of policies, identify the most effective marketing campaigns, and monitor customer satisfaction levels. This information can be used to make better decisions and improve overall business performance.

Improved Communication and Collaboration

CRM systems facilitate communication and collaboration between different departments within an insurance agency. By integrating CRM with ERP, insurance agencies can improve communication even further. For example, agents can use the CRM system to access information about a customer’s policy from the ERP system. This allows them to provide better customer service and resolve issues more quickly. Furthermore, automated notifications can be set up within the CRM to alert relevant personnel when specific actions occur within the ERP, ensuring everyone is kept in the loop.

Features to Look for in a CRM for ERP Integration

Not all CRM systems are created equal. When choosing a CRM system for ERP integration, insurance agencies should look for specific features that will facilitate the integration process and maximize the benefits of the combined system.

Open API and Integration Capabilities

The CRM system should have an open API (Application Programming Interface) that allows it to easily integrate with other systems, including ERP. This is essential for seamless data exchange and workflow automation. Look for CRM systems that offer pre-built integrations with popular ERP solutions or that provide tools for building custom integrations.

Customizable Workflows

The CRM system should allow for customizable workflows that can be tailored to the specific needs of the insurance agency. This allows the agency to automate tasks and streamline processes that are specific to their business. The workflows should be able to trigger actions in both the CRM and ERP systems, ensuring a coordinated flow of information.

Role-Based Access Control

The CRM system should provide role-based access control, which allows the agency to control which users have access to specific data and functionalities. This is important for security and compliance purposes. Different roles within the agency, such as agents, brokers, and managers, should have different levels of access to the CRM and ERP systems.

Mobile Accessibility

In today’s mobile world, it’s essential that the CRM system be accessible from mobile devices. This allows insurance professionals to access customer data and perform tasks from anywhere, at any time. The mobile CRM app should provide the same functionality as the desktop version, ensuring that users can stay productive even when they’re on the go.

Comprehensive Reporting and Analytics

The CRM system should provide comprehensive reporting and analytics capabilities that can help insurance agencies track their performance and identify areas for improvement. The reports should be customizable and should provide insights into various aspects of the business, such as sales, marketing, and customer service. The CRM should also integrate with the ERP system to provide a holistic view of the business.

Benefits of a Well-Integrated CRM–ERP System for Insurance Professionals

The benefits of a well-integrated CRM–ERP system are significant and far-reaching, impacting nearly every aspect of an insurance agency’s operations.

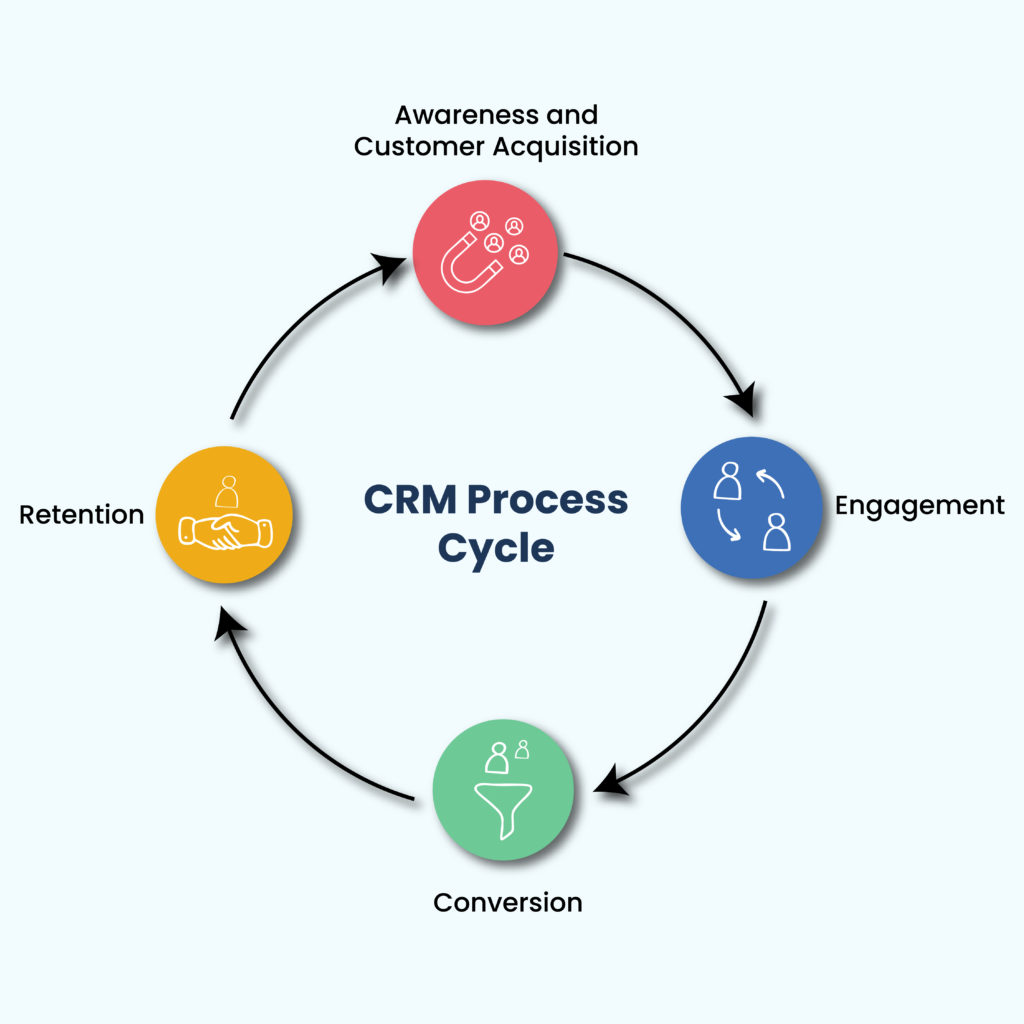

Improved Customer Service

By providing agents with a complete view of customer interactions and policy information, a well-integrated CRM–ERP system enables them to provide better customer service. Agents can quickly answer questions, resolve issues, and provide personalized recommendations. This leads to increased customer satisfaction and loyalty.

Increased Sales Productivity

By automating tasks and streamlining processes, a well-integrated CRM–ERP system frees up agents to focus on selling. Agents can spend more time building relationships with customers and closing deals. This leads to increased sales productivity and revenue.

Reduced Operational Costs

By automating tasks and eliminating manual data entry, a well-integrated CRM–ERP system reduces operational costs. This frees up resources that can be used to invest in other areas of the business.

Enhanced Decision-Making

By providing comprehensive reporting and analytics, a well-integrated CRM–ERP system enables insurance agencies to make better decisions. Agencies can track their performance, identify trends, and make informed decisions about their business strategy.

Improved Compliance

By providing security features and compliance tools, a well-integrated CRM–ERP system helps insurance agencies comply with relevant regulations. This reduces the risk of fines and penalties.

Conclusion

In conclusion, CRM plays a critical role in optimizing ERP adoption for insurance professionals. By providing a user-friendly interface, centralizing customer data, automating workflows, and providing comprehensive reporting and analytics, CRM addresses the challenges of ERP implementation and maximizes the benefits of the combined system. When choosing a CRM system for ERP integration, insurance agencies should look for specific features that will facilitate the integration process and ensure seamless data exchange and workflow automation. The benefits of a well-integrated CRM–ERP system are significant and far-reaching, impacting nearly every aspect of an insurance agency’s operations, from improved customer service to increased sales productivity and reduced operational costs. By strategically implementing and integrating these systems, insurance agencies can unlock significant competitive advantages and achieve sustainable growth in a dynamic and demanding market.

Conclusion

In conclusion, integrating a robust CRM system is no longer a luxury, but a necessity for insurance professionals seeking a seamless and successful ERP adoption. As we’ve explored, CRM acts as a vital bridge, ensuring data accuracy, fostering user buy-in, and streamlining workflows that are critical for realizing the full potential of an ERP implementation. By leveraging CRM to manage customer relationships, personalize communications, and provide comprehensive training, insurance agencies can significantly mitigate the risks associated with ERP adoption and pave the way for improved operational efficiency and enhanced customer satisfaction.

Ultimately, the synergy between CRM and ERP empowers insurance professionals to make data-driven decisions, optimize resource allocation, and deliver superior service. If you’re an insurance professional considering an ERP implementation, remember that a well-integrated CRM system is your key to unlocking its true value. Take the next step towards a more efficient and customer-centric future by exploring how a tailored CRM solution can optimize your ERP adoption. Click here to learn more about our CRM solutions designed specifically for the insurance industry.

Frequently Asked Questions (FAQ) about How CRM Optimizes ERP Adoption for Insurance Professionals

How does CRM help ERP adoption?

CRM provides enhanced data accuracy, streamlining the ERP implementation process. By integrating customer information, CRM ensures a smoother transition to the ERP system. This leads to better efficiency in insurance operations.

Why integrate CRM with ERP for insurance?

Integrating CRM and ERP enhances customer relationship management and operational efficiency. This integration provides a 360-degree view of the customer, enabling insurance professionals to offer better services. It also improves decision-making through unified data.

What are the benefits of CRM for ERP?

CRM adoption for ERP offers benefits like improved data visibility and enhanced workflow automation. Insurance professionals can access real-time customer insights, boosting sales and service quality. This integration also enables more efficient resource allocation.